In life, we all get stuck in bad deals. Whether it’s a cell phone plan, car payment, or cable bill, it feels like there’s no way out. But there are always ways to renegotiate your way into a better deal. Here are a few tips:

Renegotiate

Renegotiate means to negotiate again the contract or agreement. This usually happens when one of the parties wants to change the terms of the agreement, or when the deal expires and the parties wish to renew it.

Are you okay with losing the deal?

If you’re not willing to lose the deal, renegotiating is no point. You might as well take the deal as it is.

If you’re afraid of losing the deal, you might not get the best outcome in the negotiation. Losing the negotiation could also mean losing your credibility.

If you are okay with losing this deal, you can go back to the prospect. Tell them with friendliness:

“I only want to do these when both parties agree. And I want to be upfront with both of you.

I’m not entirely satisfied anymore.

I’m not entirely confident that the current structure of this deal will allow us to serve you long-term while still making a profit and providing you with the [servicetechnologysolution] you deserve.

I’m not confident this is the right deal for either of us. I think we could both benefit from changing this number. Would you be open to that?

It’s happened to all of us. We pursued the deal, negotiated the terms, put in the effort, and got them to sign on the dotted line.

Only to find out later that the terms of your contract are terrible. That’s the seller’s regret.

What do you do now? Do you try to salvage what you can from a bad situation?

Do you go back to them and negotiate a better deal?

How do you bring up renegotiating a deal? How do you broach the subject?

How do you tell a prospect that what they just agreed to is unacceptable? What words are best to use?

Want to learn how to negotiate like a pro? Get my free book, The Founders Guide to Negotiation.

However, there’s something much more vital that you need to consider.

Instead of focusing on tricks and tactics, think about basic psychological principles.

Tips on How to Renegotiate Your Contract

These tactics can help you improve your chances of renegotiating your contract to your benefit.

- Prepare for all possible renegotiating opportunities. This means that you should have all the information you need to ensure you are prepared and confident to negotiate the terms you desire. As it will make the process more straightforward for both sides, it is recommended that you create a contract analysis sheet. To make the process easier, you can identify your optimal Medicare reimbursement percentage before renegotiating.

- If you are unsure whether you want to end the contract or not, be aware. You don’t always need to know what renegotiation means. It will impact your negotiation skills if the renegotiation does not go your way.

- If the health plan fails to adhere to the agreement or doesn’t follow through with the changes discussed, clearly define the escalations and other legal steps you are legally permitted to take. These are implied and should be clearly stated.

Watch out for Deal breakers

If you’re unhappy with the initial contract, it may be time to renegotiate.

When negotiating new insurance contracts, watch out for any seemingly innocuous terms that benefit the insurance companies. These terms are unfairly stacked against you, and you should avoid them.

If the terms of the agreement are unsatisfactory, set up a meeting with your provider to renegotiate as soon as possible.

If any of the following terms are in your insurance contract, it is best to renegotiate as soon as possible. These terms are not fair and put all the power in the hands of the insurance company.

-Your electronic signature is not mandatory for the provider to change the terms of your agreement-You do not have access to all pricing information.-The terms used in your agreement are vague and unclear as to who has rights to the services. You are not allowed to set any boundaries or limitations in your practice.-The terms of the contract have limits that are unachievable by you or the service. The billing requirements are irregular, adding to your workload. The fees scheduled for the services or appointments not covered by your plan are confusing. You must go through a lengthy procedure to receive authorization for the treatment. The filing requirements for claims that have a time frame of fewer than 90 days are stressful.

These are the main points that insurance companies include in the contracts that benefit them, not you.

If you’re uncomfortable with a contract full of confusing terms and limits on your authority, then it’s probably not the proper one for you.

If you’re unsure about a contract, our experts at Practolytics can help ensure it’s business-centric and profitable.

Conclusion

If you find yourself in a bad deal, don’t despair! There are always ways to renegotiate your way out of it. Do your research, be prepared to walk away, and don’t take no for an answer. With these simple tips, you’ll be back on track in no time.

Need Help Automating Your Sales Prospecting Process?

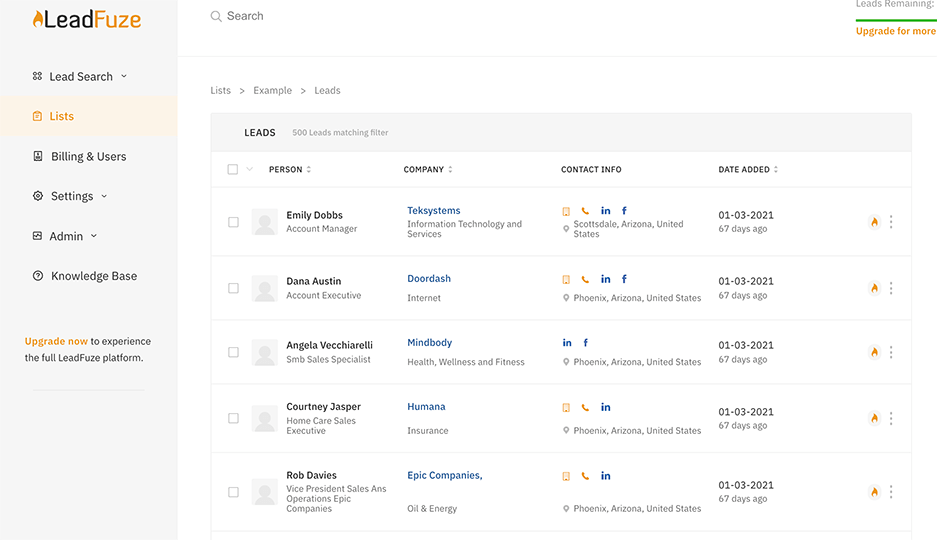

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!