Imagine standing on the precipice of a technological revolution, staring out into an ocean of possibilities. That’s exactly where you are when pondering the question: Should I invest in AI? Artificial Intelligence is like the vast sea, full of promise but also mystery. From transforming customer relationships to powering self-driving cars, AI has shown its potential for exponential growth.

This isn’t just about investing in tech companies or putting your money into another stock exchange game. It’s more than that – it’s about being part of something groundbreaking and world-changing. But just as every coin has two sides, this booming market comes with its share of risks too.

the financial pool, incorporating AI into your investment strategy can be a game changer. There are potential gains to be had but also challenges that need tackling. It’s all about striking the right balance for optimal returns.

Table of Contents:

- Understanding AI Investments

- Evaluating Risks and Rewards in AI Investments

- Diversifying with AI Funds & Technology Funds

- The Role of AI in Different Industries

- Ethical Considerations When Investing in AI

- FAQs in Relation to Should I invest in Ai

- Conclusion

Understanding AI Investments

The AI industry has been making waves, and it’s not just techies who are paying attention. Investors have started to ask a crucial question: “Should I invest in AI?”

To make an informed decision, let’s start by looking at the market size of the industry. The growth potential is immense as companies involved in artificial intelligence such as Nvidia have been strong performers on the stock exchange.

The Impact of Artificial Intelligence

Artificial Intelligence (AI) is no longer a thing of sci-fi movies. It’s real, and it’s here – revolutionizing industries across the board from healthcare to logistics.

Nvidia, one of the key players directly involved with AI development, for instance, has seen impressive revenue growth thanks to their powerful graphics processing units that fuel most modern-day AI applications. Considering their stock market performance, it is evident that investing in this field can be highly lucrative.

If you’re still asking ‘should I invest in AI?’, consider this: according to predictions made by leading research firms like Gartner or IDC, there will be an acceleration in investments into artificial intelligence over the next few years which translates into greater opportunities for investors like yourself.

Evaluating Risks & Rewards Involved In Investing In Artificial Intelligence Stocks

In any investment strategy, understanding risks associated is paramount. While it’s true that stocks related to Artificial Intelligence present considerable upside due to its rapidly evolving nature and vast application possibilities – remember high reward usually comes with some level of risk attached too. Let me put things into perspective:

An example would be when Bing search engine was introduced as a competitor against Google. Despite Microsoft’s considerable investment in Bing, it was unable to overthrow Google as the leading search engine. Hence, even if a company has AI technologies and applications that seem promising, there is no guarantee of success.

However, with careful evaluation, you can certainly leverage this volatility to your advantage. Here’s how:

- Consider diversifying investments across several different tech companies rather than putting all eggs in one basket.

- Opt for ETFs whenever feasible. They’re a solid choice for diversifying your investment portfolio.

AI investments are capturing the attention of savvy investors, thanks to promising companies like Nvidia. But remember, with high potential returns come risks too. To navigate this volatile sector successfully, consider spreading your bets across multiple tech firms and choosing exchange-traded funds for a diversified portfolio.

Evaluating Risks and Rewards in AI Investments

With AI investments offering potentially lucrative returns, it’s essential to understand the associated risks and evaluate them accordingly. But with high reward often comes high risk, including the possibility of losing your principal investment.

Navigating Investment Risks

Putting money into AI presents its own difficulties. The rapid pace of technology change can render today’s breakthrough obsolete tomorrow. Moreover, companies might fail to turn their tech prowess into sustainable profit margins due to intense competition or regulatory pressures.

This doesn’t mean you should shy away from AI investments entirely though. It means you need a clear-eyed understanding of these risks and how they impact your investment strategy.

To help protect yourself against such risks, diversification strategies come handy. By spreading your investments across various types of assets or different sectors within an asset class like stocks or bonds, you’re less likely to suffer severe losses when one type performs poorly. Check out this prospectus for more insights on smart investing techniques.

Embracing Market Volatility

No discussion about investing would be complete without touching on market volatility – those short-term fluctuations that cause prices to rise and fall unpredictably over brief periods. When dealing with innovative fields like AI where changes are frequent and sometimes drastic; these ups-and-downs become even more prominent but shouldn’t deter long-term investors who see beyond momentary hiccups towards a future shaped by intelligent machines.

- The key here is time horizon – if you’re planning for retirement 30 years down the line then occasional stock exchange bumps aren’t going drastically affect overall growth potential.

- If however your goal’s nearer say saving up house deposit then maybe putting all eggs into AI basket isn’t wise idea.

- Remember it’s not just about riding out the storm, but also understanding when those fluctuations represent real value.

The bottom line? Sure, AI investments can be a bit of a roller coaster with their risk and volatility. But if you play your cards right, they could bring in some seriously good returns over time.

AI investments are thrilling but risky, with the chance of high rewards and losses. A savvy investor needs to understand these risks and employ diversification strategies to safeguard their investment. Embrace market volatility; it’s part of investing in innovative fields like AI. With a long-term view and smart strategy, AI can yield significant returns.

Diversifying with AI Funds & Technology Funds

Adding AI to your investment strategy can give you a slice of the rapidly evolving tech market. But how do we leverage AI and technology funds for diversification? Let’s dive into it.

Understanding AI Funds

An ETF that invests in firms utilizing or creating AI technology is what’s known as an AI fund. By investing in these, you gain exposure to top-performing tech companies without needing to pick individual stocks.

Polar Capital Artificial Intelligence Fund, for example, offers an excellent opportunity to participate in the potential growth offered by artificial intelligence and machine learning technologies.

In contrast, Sanlam Global Artificial Intelligence Fund focuses on global businesses where profits benefit significantly from advancements in artificial intelligence. These include not just big names but also smaller companies making strides in specific areas of this burgeoning sector.

The Benefits of Diversification through Tech ETFs

Tech ETFs offer investors diversified access to firms engaged heavily within technological innovation such as cloud computing and generative AI development. This includes giants like Google’s parent company Alphabet who control significant shares of internet search capabilities via their Bing Search Engine while driving self-driving car initiatives under Waymo.

This strategy allows us broad coverage across different sectors which have integrated cutting-edge technology – resulting in revenue growth while mitigating risks associated with single stock investments.

For instance, L&G Artificial Intelligence UCITS ETF, focuses on companies that are likely to benefit from the long-term growth and advancement of AI technologies. These include everything from chip manufacturers like NVIDIA who create powerful graphics processing units (GPUs) for use in advanced AI applications, to software developers creating intelligent solutions across industries.

Finding a Balance: The Role of an Informed Investor

By staying informed and maintaining a diverse portfolio, you can navigate the ups and downs of tech stocks. It’s all about controlling hazard while watching out for potential openings.

Adding AI to your investment strategy can open doors to the thriving tech market. AI funds and Tech ETFs let you invest in top-tier tech firms without choosing individual stocks, giving broad exposure while mitigating single stock risks. By staying informed and maintaining a diverse portfolio, investors can navigate the fluctuating tech landscape.

The Role of AI in Different Industries

AI is more than just a trendy phrase; it is an ever-evolving technology that has been implemented in numerous industries, revolutionizing operations and producing remarkable outcomes. It’s a rapidly evolving technology that has seeped into various sectors, transforming operations and delivering groundbreaking results.

Autonomous Vehicles and Drones

Self-driving cars, once a concept of science fiction, are now making their way into the transportation industry. Companies like Tesla are leading this charge with their autonomous vehicles powered by sophisticated AI technologies. These smart machines can analyze traffic patterns, anticipate potential hazards, and make informed decisions on-the-fly.

Drones too are flying high on AI power. They’re now capable of carrying out complex tasks such as precision agriculture, rapid delivery services or even assisting in search-and-rescue missions. As an investor looking at global robotics companies, these developments show promising growth potential.

Healthcare Revolutionized by AI

Moving onto healthcare – another sector seeing significant advancements thanks to artificial intelligence. Machine learning algorithms assist doctors with diagnosis by accurately interpreting medical images while predictive analytics helps identify patients at risk for certain diseases ahead of time.

This wave doesn’t stop here; we’ve also got robotic surgery guided by advanced AI systems improving patient outcomes significantly. A quick glance at the stock market shows strong performances from companies directly involved in this form of healthcare-focused AI.

Ethical Considerations When Investing in AI

When it comes to investing, ethical considerations can sometimes be overlooked. Putting money into AI may lead to overlooking ethical considerations, yet they must be brought to the fore when looking at entering this rapidly growing realm.

Charles Schwab & Co., Inc, a well-known investment firm, has noted that one significant concern is privacy. As AI technologies become more integrated into our lives, questions arise around how personal data is used and who has access to it.

Bias in AI is another pressing issue. Algorithms learn from the data they are given; if this data contains inherent biases or prejudices, the resulting technology will too. For instance, facial recognition software may perform poorly for people of certain ethnicities if its training set was not diverse enough.

Regulation: A Double-Edged Sword

The wild west days of unchecked tech development might soon be over as governments start tightening regulations on tech companies with regards to their use of AI applications. While this might seem like an obstacle for growth potential, smart investors view regulation as a tool that helps ensure long-term sustainability by keeping check on reckless expansionism.

This balance between profit margins and ethics could lead to increased market volatility among stocks involved with AI – making investment returns unpredictable but potentially high-rewarding for informed investors who play their cards right.

Transparency: The Key To Trustworthy Tech?

In today’s era where “fake news” runs rampant online, transparency becomes paramount in maintaining customer relationships while building new ones. In other words – do we understand why an algorithm makes a particular decision? Is there a way to question its conclusions?

Transparency in this context isn’t only about elucidating the algorithm’s process, but also holding those accountable for any errors that arise from it. If something goes wrong with an AI system – who’s responsible? The developers of the software? The users?

The Rising Tide of Ethical AI

We’ve just received a new report. More on this topic soon.

When investing in AI, ethical considerations like privacy and bias shouldn’t be ignored. With the rise of regulations for tech companies using AI applications, there’s a balance to strike between profits and ethics which could lead to market volatility. Transparency is crucial – it’s not just about understanding an algorithm but also who’s accountable when things go wrong.

FAQs in Relation to Should I invest in Ai

Are AI stocks a good investment?

AI stocks can be solid investments, as they’re part of an industry that’s growing fast. Just remember to research before diving in.

Is AI a good investment in 2023?

Predicting exact market trends is tough, but given the rapid advancements and demand for AI tech, it could still be a promising bet.

What AI company is Elon Musk investing in?

Musk heavily invests in OpenAI and Neuralink—both key players pushing boundaries with artificial intelligence technology.

What are the top 3 AI stocks to buy now?

Nvidia, Alphabet (Google), and Microsoft stand out among top performers—but don’t forget to do your own due diligence first.

Conclusion

Should I invest in AI? It’s a deliberation worth pondering. Remember, this is about more than just another stock exchange play. Contemplate a chance to partake in something groundbreaking.

Investing in AI holds potential for high returns, but don’t forget the risks involved. The market volatility and rapidly evolving nature of technology are factors you can’t ignore.

Diversification is key when it comes to investing in AI companies – from giants like Nvidia to promising smaller companies working on groundbreaking technologies. And always remember: long-term investment strategies tend to weather short-term fluctuations better.

The tremendous impact AI has had across numerous industries, from healthcare to finance and even self-driving cars, is constantly expanding. But tread carefully around ethical issues such as privacy concerns or bias inherent in some applications of artificial intelligence.

In conclusion, keep your eyes open wide while diving into the deep sea of possibilities that come with adding AI investments into your portfolio. Stay informed and stay vigilant!

Need Help Automating Your Sales Prospecting Process?

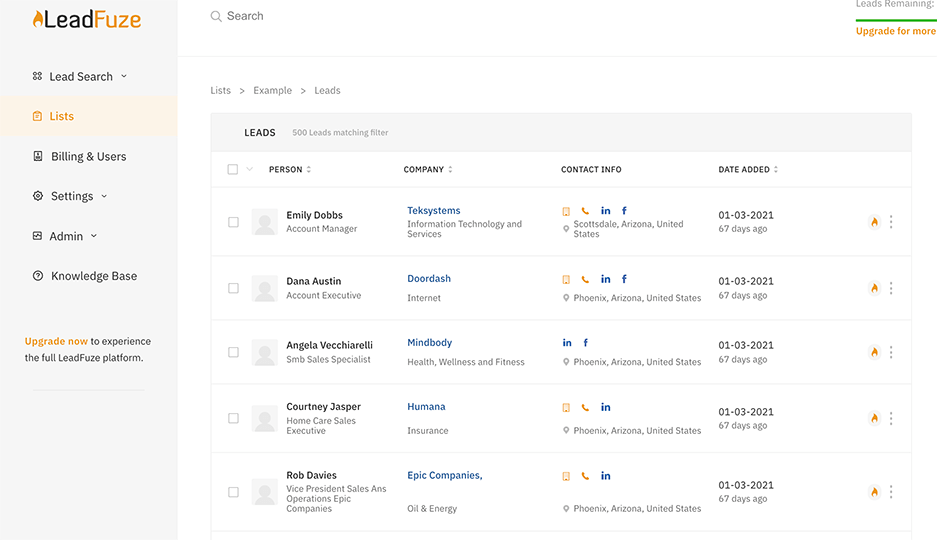

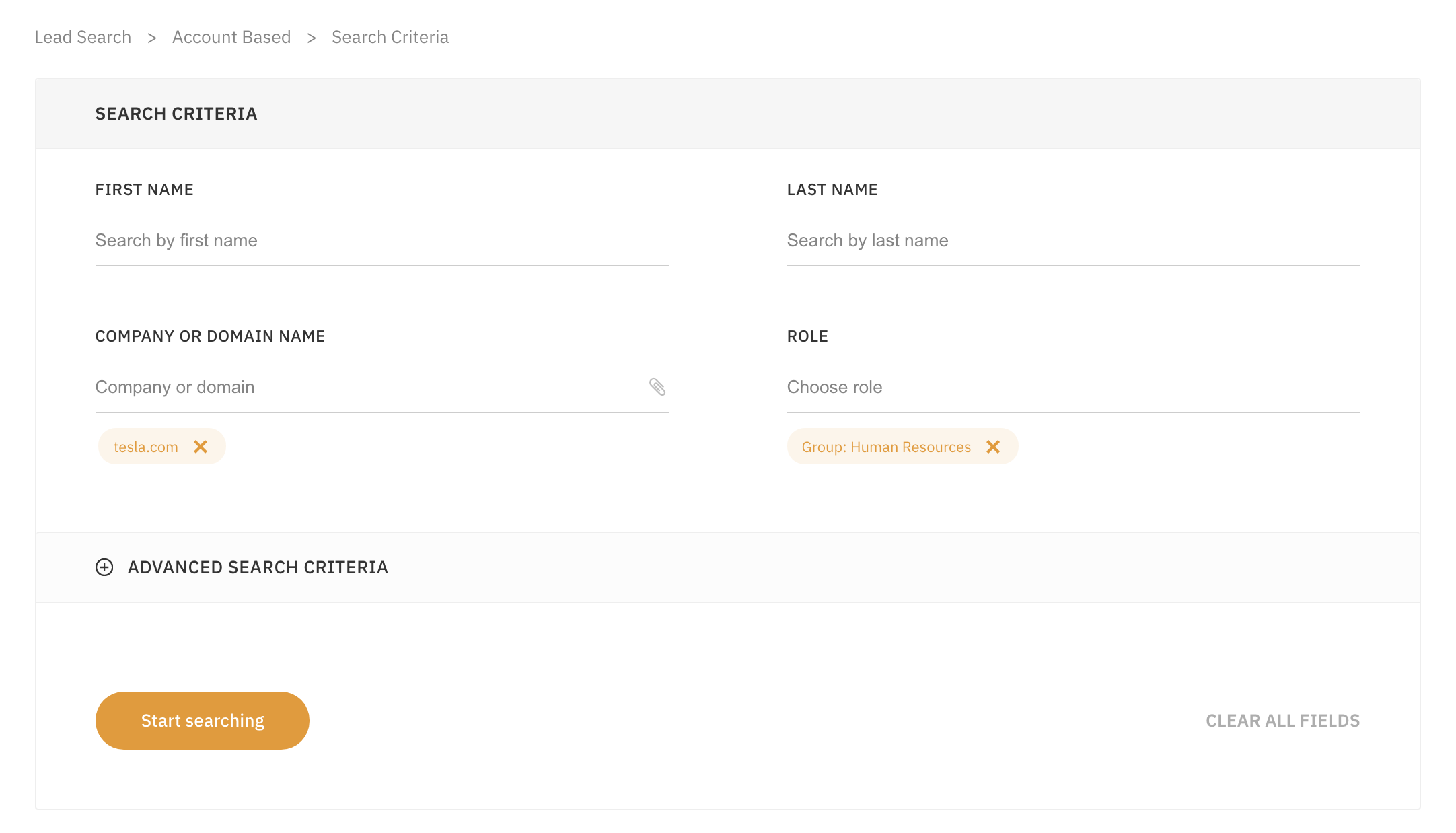

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!