Understanding what might lead to an expansion in the business cycle is key for anyone keeping a pulse on economic trends. In this piece, we’ll dissect pivotal elements like monetary policy and its power to steer markets. You’ll also get insights into how fiscal strategies can pump energy into economies and why consumer spending often acts as the lifeblood of growth phases.

We’re digging deep into technological advancements too, revealing their critical role in pushing productivity forward. Plus, with a nod to economic theories and real-world case studies, you’ll walk away with a richer grasp of these complex dynamics. Stick around for actionable knowledge that could sharpen your investment decisions or business strategies.

Table of Contents:

- Economic Indicators Signaling Business Cycle Expansion

- The Influence of Monetary Policy on Business Cycle Dynamics

- Fiscal Strategies Encouraging Economic Growth

- Technological Advancements Fueling Economic Expansion

- Determinants Leading to Business Cycle Expansion

- Economic Theories Explaining Business Cycles

- The Role Of Consumer Spending In Business Cycle Phases

- Case Studies Of Historical Economic Expansions

- Conclusion

Economic Indicators Signaling Business Cycle Expansion

When the business cycle hits an expansion phase, it’s like a party for the economy. More jobs, fatter wallets, and businesses popping up like toast. But what clues us into this economic shindig? Let’s talk indicators.

Gross Domestic Product as a Growth Measure

The Gross Domestic Product (GDP) is pretty much the heavyweight champ of economic metrics. It measures everything our economy produces in dollars and cents—if GDP is on the rise, you can bet your bottom dollar we’re likely cruising into an expansion phase. Think of GDP growth as that friend who always shows up to your party first—it sets the mood for what’s coming.

In fact, since about 1950 or so—give or take—the average U.S. economic cycle has been around five and a half years from start to finish before resetting again with another boom period.

Employment Rates During Economic Expansion

A surefire sign that things are looking up? Jobs galore. When companies feel confident enough to hire more folks, employment rates go up—which means people have more money to spend on stuff they probably don’t need but definitely want (hello consumerism.). High employment doesn’t just mean less awkward small talk at family gatherings; it also hints at stronger demand pushing production levels higher across industries.

Consumer Confidence’s Impact on Economic Health

Last but not least: consumer confidence—aka how regular Joes and Janes feel about spending their hard-earned cash—is like social proof for economists that good times are rolling in. When consumers believe tomorrow will be better than today financially speaking—they’ll loosen those purse strings faster than grandma after her second glass of wine at Thanksgiving dinner.

This isn’t just theory talking; strong consumer sentiment often leads directly to increased consumer spending which then fuels even more robust business investment decisions—a virtuous circle if there ever was one.

All these factors dance together in step with fiscal policy moves by Uncle Sam—or any government really—and monetary policy tweaks by central banks (like changing interest rates), creating rhythms we call business cycles… And right now? We might just be hearing music starting again…

When GDP grows, jobs boom, and wallets fatten, it’s a sign we’re heading for an economic expansion. These indicators don’t just hint at growth; they spark spending sprees and business investments that keep the good times rolling.

The Influence of Monetary Policy on Business Cycle Dynamics

Imagine the economy as a car, and central banks like the Federal Reserve are in the driver’s seat with their hands on the monetary policy levers. They can push growth into high gear or pump the brakes when needed to maintain balance. When they opt for an expansionary monetary policy, it’s like stepping on the gas—lowering interest rates and increasing money supply—to help speed up economic activity.

Central Banks’ Role in Economic Management

Central banks wield significant power over our financial lives, often without us even realizing it. By adjusting interest rates and controlling money supply, they work behind-the-scenes to influence employment levels and consumer spending—the very heartbeat of economic health. But that’s not all; these institutions also have a hand in managing inflation to keep prices stable while striving for maximum sustainable output—a juggling act worthy of a circus performer.

A prime example is how monetary policy tools come into play during different phases of business cycles. Take expansionary policies: when executed effectively, such measures can stimulate borrowing by making credit cheaper—which means businesses invest more and consumers buy more—propelling gross domestic product (GDP) upwards.

In this dance between central bank decisions and economic outcomes, sometimes things heat up too much leading to what we call ‘overheating.’ That’s when you’ll see these magicians employ contractionary monetary policy—increasing interest rates to cool down investment fervor before it turns into an inflation party nobody wants an invite to.

To understand just how pivotal these strategies are consider this: since 1950s U.S., average business cycles have lasted about five-and-a-half years—from peak phase back around again—and central banks’ maneuvers greatly contribute to either extending or curtailing those periods through careful calibration based on observed indicators from real GDP data sourced from entities such as NBER’s cycle dating research.

If you’re wondering why your savings account interests ebb flow—that’s them at work. It isn’t magic; it’s economics.

Think of the economy as a car, with central banks driving it using monetary policy. They steer through interest rates and money supply to either speed up or slow down our financial health.

Central banks are like behind-the-scenes magicians, juggling inflation and growth by making credit cheaper or more expensive—which affects everything from business investments to your savings account interest.

Fiscal Strategies Encouraging Economic Growth

When it comes to jazzing up the business cycle, few things can groove like a well-played saxophone of fiscal policy. Picture Uncle Sam as the bandleader, with tax policies and government spending as his instruments tuning up for an economic jam session designed to boost growth.

Role of Fiscal Policy in Promoting Economic Growth

The tempo is set by strategic adjustments in taxes and public expenditures. Think lower taxes giving folks more dough to spend or save, potentially cranking up consumer demand faster than a hot vinyl record on a summer day. And when the government puts cash into infrastructure projects? That’s not just roads getting laid down; it’s jobs being created and money making its rounds through local diners, shops, and services.

Fiscal maneuvers have got clout, no doubt – they can steer economies away from potholes toward smoother lanes where business investment blossoms like spring flowers after winter thaw.

Impact of Tax Policies on The Business Cycle

Tax cuts might sound sweet like sugar but need careful mixing lest they stir inflation instead of stirring grooves. Yet if done right – especially when timed during slower beats in the economy – they could pump volume back into production levels while fostering corporate profits that hum along nicely with rising stock market tunes.

In contrast, bumping up taxes too high could scratch records mid-song; damping down consumer spending quicker than a DJ drops bass at closing time. So there’s always this funky dance between taking enough but not too much — keeping that rhythm steady so businesses feel confident investing in capital goods without fear of tripping over their own shoelaces.

Economic Expansion: Jamming Beyond Just Numbers

So, when it comes to keeping that rhythm alive, smart policy decisions are key. They set the tempo for job creation and stable markets—just what we need for a thriving economy where folks don’t just survive; they flourish.

.

Fiscal policy is like a band leader, using tax cuts and spending to jazz up the economy. It’s all about hitting the right notes with strategic adjustments that boost growth, create jobs, and keep businesses investing confidently.

Technological Advancements Fueling Economic Expansion

The business cycle often finds a powerful ally in technology. Innovations in this arena can kickstart periods of remarkable productivity growth, becoming the backbone of economic expansions.

Gross Domestic Product as a Growth Measure

When we talk about technological advancements, think about how they’re reflected in our Gross Domestic Product (GDP). This metric gives us the big picture—how much value is added to the economy thanks to new tech. From cloud computing boosting efficiency to AI streamlining logistics, these innovations are more than just gadgets; they’re catalysts for change that drive up GDP numbers and signal healthy expansion phases within business cycles.

And it’s not just speculation—the stats back it up. The average U.S. economic cycle has lasted roughly five and a half years since the 1950s, with technology playing an increasingly significant role each time around.

Employment Rates During Economic Expansion

New technologies don’t only churn out products faster—they also create jobs. Employment rates often soar during an expansion phase because companies need more hands on deck to handle innovation-driven growth.

This isn’t old news either; look at any major leap forward from smartphones to renewable energy sources—it’s clear that tech pushes employment figures upward by creating demand for skilled labor ready to tackle tomorrow’s challenges today.

Consumer Confidence’s Impact on Economic Health

Tech goes beyond machinery and software—it shapes consumer confidence too. When folks see breakthroughs like electric cars or smart homes hit the market, their excitement translates into spending which bolsters overall economic health.

We’ve seen this effect play out across various sectors where new tech leads consumers down paths previously unimagined—paths paved with dollars spent willingly amid rising optimism about what lies ahead economically speaking.

With every swipe of their smartphone or click on a laptop powered by lightning-fast processors and next-gen connectivity, consumers demonstrate how deeply integrated technology is with both personal lives and broader macroeconomic trends.

In short: keep your eyes peeled for those moments when Silicon Valley releases its latest creation—they might just herald the start of another chapter in our ongoing story of economic expansion fueled by technological prowess.

Technology sparks economic growth by powering up productivity and GDP, while also creating jobs that boost employment rates. As consumers get excited about new tech like electric cars or smart homes, their spending drives the economy even further.

Determinants Leading to Business Cycle Expansion

When the economic cycle hits an upswing, it’s like a well-oiled machine humming along—the more parts working together, the smoother it runs. Let’s talk turkey about what cranks up this complex machinery.

Fiscal Measures Spurring Growth

First off, think of fiscal policy as a power-up in your favorite video game. When governments open their wallets for public projects or cut taxes, they’re basically hitting the boost button on economic activity. It’s not just theory; when Uncle Sam spends more or takes less from our pockets, businesses often follow suit by increasing investment and hiring—kindling that fuels growth faster than dry wood in a bonfire.

Tax policies aren’t child’s play either—they can influence how much money folks have to spend or save. More spending means higher demand for goods and services—a clear path toward expansion territory where every sale is another step away from the economy’s lowest point.

The Consumer Behavior Effect

Moving on to consumer behavior—it’s pretty simple: if people feel confident about their financial future, they’ll likely loosen those purse strings. This uptick in consumer confidence leads them down aisles both physical and digital—to splurge rather than squirrel away cash under mattresses (which does zilch for gross domestic product). Remember though, this isn’t some hocus-pocus; we’ve got hard data backing this claim with average U.S. business cycles lasting around five years since the ’50s.

The Global Influence

Last but certainly not least comes global influence—and boy does it pack a punch. International trade isn’t just exotic packages crossing borders; it affects jobs back home and ultimately swings national production levels one way or another.

In today’s interconnected world markets are kind of like spider webs—tug at one strand (like making borrowing cheaper through lower interest rates), you’ll see movement everywhere else too—including potential spurts of economic growth right here on Main Street USA thanks to foreign dollars spent on exports made stateside.

Think of fiscal policy as hitting the boost button on the economy. When governments spend or cut taxes, businesses ramp up investment and hiring, sparking growth.

If people are feeling good about their finances, they’ll spend more—fueling economic expansion with every purchase.

Global trade’s not just a game of international shipments; it directly affects local jobs and can lead to spurts of growth at home thanks to foreign spending on our exports.

Economic Theories Explaining Business Cycles

Ever feel like the economy is a roller coaster, sometimes at the peak and other times diving down? That’s where economic theories step in to explain these ups and downs. They’re kind of like instructions for building that roller coaster. Among them, Keynesian economics shines a spotlight on aggregate demand—the collective spending mojo of consumers and businesses—as a major player in business cycle fluctuations.

The beauty of this model lies in its simplicity: when people have more dough to spend, they buy more stuff; companies respond by making more things, which means hiring more folks. It’s an upward spiral leading to what we call an expansion phase—good times all around. But here’s the kicker: even if everyone wants to keep partying economically speaking, there are warning signs that can suggest it’s time for moderation.

Gross Domestic Product as a Growth Measure

Think of Gross Domestic Product (GDP) as society’s scoreboard—it tallies up everything produced within our borders. When GDP grows faster than your friend bragging about their stock market wins—boom—we’re likely talking expansion phase territory. Fun fact: since the 1950s, the average U.S economic cycle has lasted roughly five and a half years. Not too shabby.

Employment Rates During Economic Expansion

Joyful days indeed when unemployment rates dip lower than your last limbo challenge. More jobs usually mean happy voters and healthier economies because employed people tend to spend confidently knowing their paychecks are secure.

Consumer Confidence’s Impact on Economic Health

If consumer confidence were a person at a party, they’d be turning up with good vibes only. This stat measures how optimistic folks are about their financial future—if high enough, you bet it’ll juice up consumer spending and add fuel to growth flames.

Weaving through these economic cycles feels less dizzying once you get why each part matters—from employment levels impacting consumer wallets directly or monetary policy subtly pulling strings from behind central bank curtains. Keynesian models emphasize exactly this interconnectedness, reminding us that every dollar spent creates ripples throughout our entire pond-sized economy.

Economic theories are like roller coaster instructions, explaining the economy’s highs and lows. Keynesian economics sees spending as key: more money means more purchases, leading to business growth and job creation. GDP measures our economic output—when it spikes, so does expansion. Low unemployment boosts consumer confidence which then powers up spending further—it’s all connected.

The Role Of Consumer Spending In Business Cycle Phases

When the cash registers start singing, and shopping carts become a parade down store aisles, you know consumer spending is up. This isn’t just good news for retailers; it’s a sign of healthy economic times ahead. Think about it like this: every dollar spent by consumers pumps life into businesses big and small, fueling what economists call an expansion phase in the business cycle.

Influence Of Consumer Spending On The Business Cycle

We’ve seen that on average, since the 1950s, U.S. economic cycles have lasted about five and a half years—a testament to how consumer habits shape our economy’s heartbeat. When folks feel confident enough to spend more on everything from avocado toast to zippy electric cars, we’re likely cruising towards better days economically speaking. It makes sense when you realize that consumer spending accounts for over two-thirds of gross domestic product (GDP), making it a heavyweight champion in driving growth.

This buying behavior doesn’t just happen in a vacuum—it’s closely linked with other sunny-side-up indicators like rising employment rates and growing corporate profits which all add up to spell out ‘expansion’ in bright neon lights across national economies.

Gross Domestic Product as A Growth Measure

GDP growth rolls out the red carpet for expansions by measuring how much value we’re creating as an economy—more goods produced equals more jobs equals more money being spent…you get the picture. Now imagine GDP is your car’s speedometer; when those numbers climb higher than Everest Base Camp altitude levels—that’s prime time expansion territory right there.

Consumer Confidence’s Impact On Economic Health

A key player here is none other than Mr,Ms. Confidence—yeah I’m talking about consumer confidence. When people are feeling good about their financial futures they don’t hold back on splurging now because they believe tomorrow will take care of itself—and usually—they’re spot-on. So next time you hear someone say “The future looks bright,” bet your bottom dollar they’re not just wearing rose-colored glasses—they’ve probably spotted some positive vibes radiating off strong consumer sentiment stats.

To wrap things up before I send you packing with anticipation—the rhythm of cash flowing through registers sings harmoniously with other aspects such as robust employment figures or smart central bank policies—which together pave golden paths leading us toward greener pastures known fondly as ‘economic expansions’.

When shopping carts fill up and cash registers ring, it’s a sign of an economic upswing. Consumer spending isn’t just retail therapy—it’s the lifeblood pumping through our economy’s veins, driving over two-thirds of our GDP and spelling out ‘expansion’ in bright neon lights.

GDP growth measures value creation; when it skyrockets, so does prosperity. Feeling financially confident? People spend more today believing tomorrow looks good—this optimism feeds into healthier economies. All this adds to a chorus where employment rates and smart policies harmonize for robust economic expansions.

Case Studies Of Historical Economic Expansions

The stories of past business cycle expansions are like a treasure trove for those looking to understand the secret sauce of economic growth. Take, for instance, the notable expansion that began in March 1991 and lasted roughly ten years; it was an era where gross domestic product (GDP) saw its waltz with prosperity.

Gross Domestic Product as a Growth Measure

Historically speaking, GDP has been our go-to barometer for measuring an economy’s health. It’s kind of like taking the economy’s temperature – too high or too low can signal trouble ahead. For example, during historical periods such as the one starting from 1991, rising GDP numbers painted a picture of strong economic expansion filled with corporate earnings sunshine and consumer spending rainbows.

A visit to Business Cycle Dating reveals that this golden period had us seeing average annual real GDP growth rates dance between robust figures signaling not just recovery but also natural growth built on solid ground.

Employment Rates During Economic Expansion

We all know jobs are pretty much oxygen for economic well-being—no surprise there. The employment levels during times of boom act almost like cheerleaders rooting for further gains across sectors. Case studies show how lower unemployment kickstarts consumer confidence leading to more spending and thus juicing up aggregate demand even more.

Consumer Confidence’s Impact on Economic Health

Spenders gonna spend when they feel good about their financial future—that’s what history tells us about consumer confidence. This sentiment acts as fuel in the engine room powering through different phases within business cycles towards expansive shores. If you peek back at previous expansions detailed by US Business Cycle Expansions and Contractions, you’ll spot this pattern repeated time after time—a testament to human behavior driving economies forward or pulling them back.

In these historical scrolls lies wisdom—not just dusty facts but vibrant lessons that teach us triggers capable of propelling tomorrow’s growth stories because let’s face it: understanding where we’ve been gives us some seriously smart clues about where we’re headed.

Dive into past economic expansions to grasp the growth triggers: robust GDP, strong employment, and high consumer confidence. They’re not just history—they’re lessons for future prosperity.

Conclusion

Grasping what might lead to an expansion in the business cycle is crucial. You’ve seen how GDP, employment rates, and consumer spending are big players here. Remember, when folks feel good about their finances, they spend more. That’s a key takeaway.

Don’t forget the power of monetary policy either. Central banks like the Federal Reserve have serious clout; their decisions can fuel growth or pump the brakes on it.

Tech advancements? They’re game-changers for productivity and economic vigor. And let’s not overlook government strategies — from taxes to spending — that set off sparks in our financial systems.

Last but not least: It all ties together! Fiscal measures meet consumer behavior meets global trade moves – each factor feeds into another, propelling us forward or holding us back.

You now know more about navigating these waters with savvy and foresight because understanding these cycles means being ready for whatever comes next in our economy’s ebb and flow.

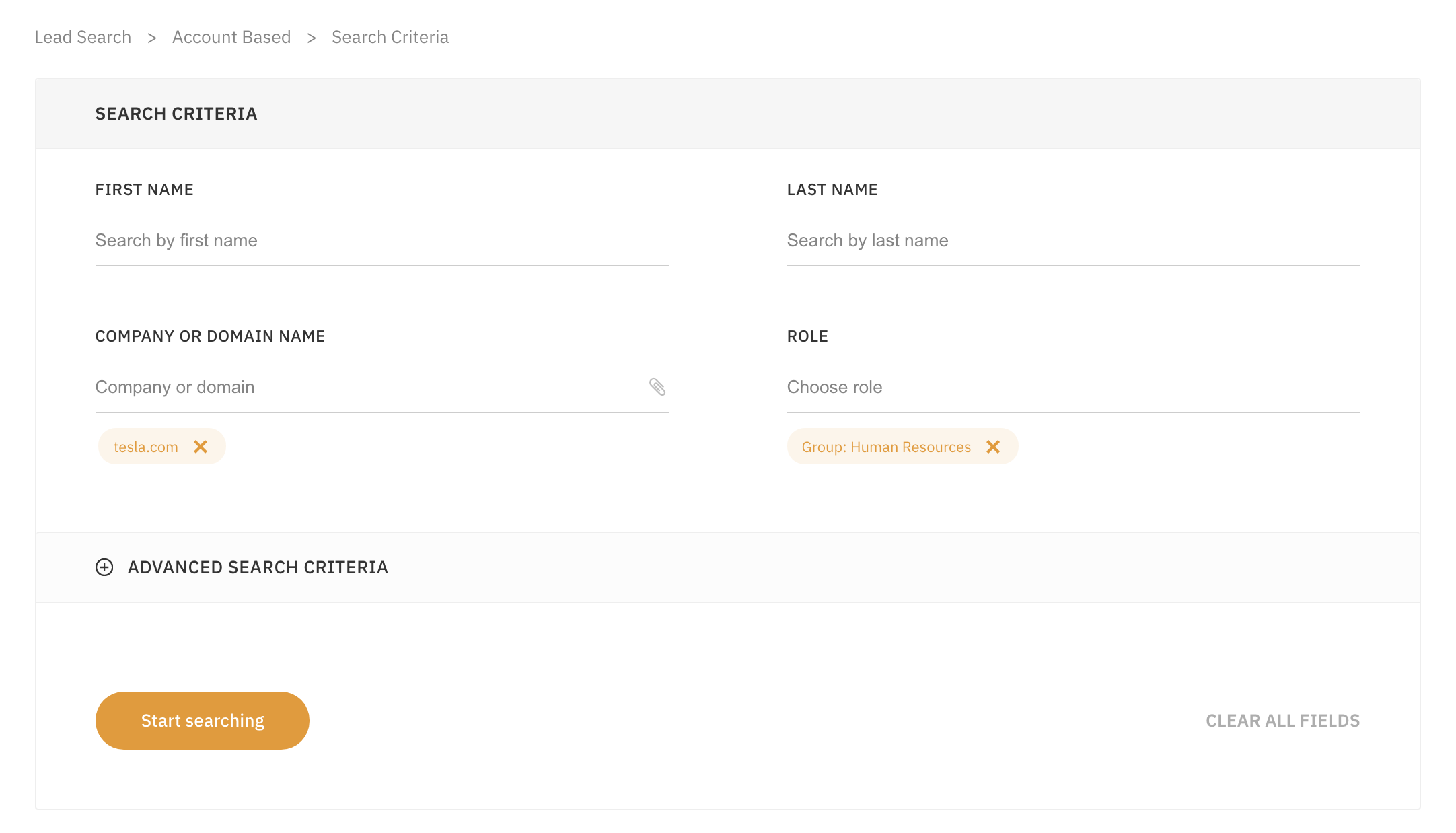

Need Help Automating Your Sales Prospecting Process?

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!