Have you ever stopped to wonder about the intricate world of stock trading? It’s a game, but with real money and real consequences. From buying your first shares to analyzing complex market trends – it all stems from centuries-old traditions and innovations that make up the rich tapestry of the history of the stock market.

The journey through time is filled with tales as captivating as any adventure novel. You’ll learn how financial visionaries under Buttonwood Tree laid foundations for what we now know as New York Stock Exchange (NYSE). Picture bustling streets in New York City where modern finance was born.

But remember, every crash has its own unique story and impact. We’ll uncover the tales behind these dramatic downturns, providing insight into their causes and effects. This journey will not only shed light on past events but also equip you with knowledge to navigate future market fluctuations.

Table of Contents:

- The Origins of the Stock Market

- Evolution and Expansion of Stock Exchanges

- Technological Innovations in Stock Trading

- The Stock Market Crash of 1929

- Regulatory Reforms in Response to Market Crashes

- Diversity and Inclusion in Stock Exchanges

- The Impact of COVID-19 on Stock Exchanges

- FAQs in Relation to History of the Stock Market

- Conclusion

The Origins of the Stock Market

Can’t help but imagine the frenzied activity on Wall Street when discussing stock markets. Do you have knowledge of its beginning? The NYSE was founded on May 17, 1792, and its beginnings can be traced back to the Dutch settlers who established New Amsterdam in the 1600s.

The genesis of the NYSE dates back to when Dutch colonists founded New Amsterdam in the 1600s, a settlement which would eventually become modern-day NYC.

The Role of Alexander Hamilton in NYSE’s Establishment

A key player who deserves mention here is none other than Alexander Hamilton. His financial policies laid down a solid groundwork for what would eventually become one of the world’s largest stock exchanges.

One major turning point was something called the Buttonwood Agreement – sounds peculiar doesn’t it? Well, under this agreement signed beneath a buttonwood tree on Wall Street, twenty-four brokers decided to trade securities only among themselves and set rules for doing so.

The Buttonwood Agreement, named after that historic tree where they gathered, became instrumental in shaping not just NYSE but also influencing capital markets around the globe.

No longer were companies limited by their own cash reserves or private loans; selling shares publicly opened up new avenues to raise funds needed for expansion or innovation – thus birthing listed companies as we know them today.

So next time you check your stocks app or ponder over Dow Jones industrial average figures, remember – these aren’t mere numbers. They’re part of an ongoing narrative shaped centuries ago beneath a simple buttonwood tree.

Evolution and Expansion of Stock Exchanges

The stock market landscape has witnessed massive transformations since its inception. But the advent of other stock exchanges like the Philadelphia Stock Exchange and American Stock Exchange truly marks an era of evolution and expansion.

Philadelphia’s Pioneer Role in Trading Securities

The Philadelphia Stock Exchange’s founding in 1790 was a major milestone for capital markets, setting the stage for how subsequent stock exchanges would function. This was not just another trading floor; it became an active exchange where investors could buy or sell shares with more transparency.

In many ways, this set rules for how future stock exchanges would operate. By offering a secure platform to trade securities, it allowed companies to raise capital efficiently while giving investors access to promising ventures.

American Revolution: From Curb Market to AMEX

An interesting chapter in our journey is the birth story of The American Stock Exchange (AMEX). Initially known as ‘Curb Market,’ due to brokers conducting trades on city curbs, it officially transformed into AMEX only in 1953.

This transformation signifies much more than just a name change—it reflects growth from informal street trading into one world’s largest regulated stock markets.

Transition from Open Outcry to Electronic Trading

Say goodbye to “open outcry”. This method dominated the early days when traders used hand signals and shouting across chaotic trading floors—talk about stress at work.

Evolving technology sparked seismic shifts toward electronic systems, letting us bid farewell to noisy outcries without shedding tears (unless they’re happy ones.). Today’s traders appreciate these advancements—they get their beauty sleep while computers handle high-frequency trades all night long.

Technological Innovations in Stock Trading

The stock market has always been a place of innovation, but nothing changed the game more than the introduction of technology. Let’s take a stroll down memory lane to see how these advancements revolutionized stock trading.

The Advent of The Stock Ticker

In 1867, something remarkable happened – the birth of the stock ticker. This machine transmitted stock prices over telegraph lines and onto small paper strips known as “ticker tape”. Imagine that. Traders no longer had to be physically present on Wall Street to get real-time information. They could simply read their ticker tapes from anywhere.

Rise of Computerized Trading Systems

Fast forward a century or so and we find ourselves smack dab in the middle of another revolution – computerization. During the 1960s and 1970s, NYSE began implementing electronic systems for trade execution. Why is this important? Because it made trades faster, more efficient, and let brokers handle higher volumes without breaking into cold sweats.

Enter: Electronic Trading Platforms

Gone were the days when traders shouted orders across crowded floors; welcome to an era where you can buy or sell shares with just one click (while sipping coffee.). With Electronic Communication Networks (ECNs), investors now have direct access to other participants in currency markets around-the-clock. Who knew convenience was only an algorithm away?

A Glimpse Into Hybrid Market System

Surely combining two good things makes something great? That’s exactly what happened with hybrid markets. These mix traditional floor-based trading with electronic ones offering benefits like increased liquidity and better price discovery. Seems like a beneficial arrangement, right?

The Surge in Trading Volumes

These tech advancements didn’t just make trading more efficient; they made it popular. The result? A significant increase in daily trading volumes and market participants. In other words, more people got to play the stock market game.

way. It’s a journey filled with remarkable changes and advancements, each paving the way for the next. And it doesn’t stop here; technology continues to revolutionize stock trading, always opening up new possibilities.

Technology has been a game-changer in the stock market’s history, introducing pivotal innovations that reshaped trading. From the advent of the 1867 stock ticker to today’s hybrid markets combining floor-based and electronic trading, technology has made trades faster, more efficient and accessible to many. The story doesn’t end here as it continues evolving with new possibilities.

The Stock Market Crash of 1929

Black Tuesday, October 24, 1929. A date forever etched in the annals of financial history as the day when stock markets came crashing down.

This cataclysmic occurrence caused a massive upheaval in both fiscal organizations and people’s homes. It all started with Wall Street brokers who were overly enthusiastic about selling shares they didn’t own yet – called “shorting”. They believed prices would fall, allowing them to buy cheaper stocks later to cover their positions.

A Dive into Black Monday

The expectation was like a self-realizing prophecy. On what is now known as Black Monday, investors panicked and began dumping stocks en masse, causing prices to plummet rapidly.

So rapid was this sell-off that by close of trading on Black Tuesday; Dow Jones Industrial Average had fallen dramatically—a significant market crash unlike any seen before it.

Cascading Consequences: Financial Institutions & Beyond

Now imagine you’re living in those times—no internet or live news updates at your fingertips. The devastating effects weren’t immediately apparent for most folks outside Wall Street. But soon enough banks began failing because they’d loaned money against stocks whose value had tanked—and not everyone could pay up.

This ripple effect led many Americans into dire straits—with some even losing their homes while others saw life savings wiped out overnight.

Bouncing Back from Black Tuesday: Lessons Learned

“Those who cannot remember the past are condemned to repeat it.” – George Santayana

The catastrophic consequences of unchecked speculation are remembered in the 1929 stock market crash, prompting regulatory safeguards such as trading halts and circuit breakers. It’s also why regulatory safeguards like trading halts and circuit breakers are now in place to prevent similar catastrophic events.

essentially, Black Tuesday wasn’t just an event. It was a tough lesson that showed us how crucial it is to keep a balance.

Black Tuesday, 1929. The day the stock market crumbled, leaving a trail of financial ruin in its wake due to unchecked speculation and ‘shorting’ stocks. A harsh reminder of what can happen when balance is lost. This catastrophic event led to new regulations like trading halts and circuit breakers, teaching us that history’s lessons are not only valuable but necessary.

Regulatory Reforms in Response to Market Crashes

The history of the stock market is marked by periods of growth and downturns. But it’s through these turbulent times that important regulatory changes come into play, particularly after significant crashes.

Take for instance the infamous crash of 1929. It wasn’t just a devastating event; it was also an opportunity for reflection and change within financial markets. The repercussions were felt across economies worldwide, but out of this chaos emerged crucial reforms.

The Birthplace of Securities Regulations

In response to this economic turmoil, U.S legislators introduced critical regulations aimed at restoring public trust in capital markets. The result? Creation of the Securities and Exchange Commission (SEC), which continues to oversee securities trading till today.

This regulatory body came into existence post-crash with its primary goal being maintaining fair and orderly functioning of securities markets while protecting investors from fraudulent activities. And thus began a new era where financial oversight became synonymous with investor protection.

Pivotal Role Of SEC In Capital Markets

The role played by SEC can’t be overstated as they serve as watchdogs ensuring transparency in operations within securities exchanges like NYSE ARCA or Philadelphia Stock Exchange amongst others, so investors could confidently participate without fear. After all, “an ounce of prevention is worth a pound.”

Serving their mandate effectively has not only helped stabilize American stock market but has fostered healthy competition among various exchanges including world’s largest such as NYSE Euronext or Intercontinental exchange further reinforcing investor confidence over time.

Diversity and Inclusion in Stock Exchanges

Breaking barriers and shattering glass ceilings, the world of stock exchanges has witnessed remarkable strides in diversity and inclusion. This progress can be seen clearly within the esteemed halls of the New York Stock Exchange (NYSE).

The First Woman President of NYSE

In 2018, a significant milestone was reached when Stacey Cunningham was appointed as the first woman president of NYSE. But this groundbreaking moment didn’t come overnight.

Muriel Siebert had paved the way decades earlier. In 1967, Muriel Siebert made history as the first female to acquire a seat on the New York Stock Exchange, thus becoming its permanent member.

Cunningham’s appointment marked another giant leap forward for diversification within this historically male-dominated institution. Her leadership role is not just symbolic but also demonstrates that women have what it takes to lead at top levels in financial markets globally.

The path towards inclusivity doesn’t stop there; NYSE saw further diversity with Joseph L. Searles III making history by being inaugurated as its first Black member only six years after Siebert’s pioneering step into Wall Street.

Raising Diversity Standards across Global Financial Markets

Apart from setting an example for American stock exchanges, these milestones send out powerful signals worldwide about breaking traditional norms within capital markets such as London’s FTSE or Tokyo’s Nikkei where senior roles are often filled by men.

National Association boards like NASDAQ now mandate listed companies include diverse members – gender identity or race – showcasing how serious marketplaces are taking diversification initiatives.

Fostering Growth through Inclusive Practices

Diversity is more than a buzzword in today’s world; it’s an essential element of business growth. It brings fresh perspectives, fosters innovation, and reflects the diverse makeup of stakeholders, from employees to investors.

The NYSE has come a long way since its foundation over two centuries ago. The exchange continues to evolve, becoming not only the world’s largest marketplace for public companies but also a beacon of diversity and inclusion.

Stock exchanges, like the NYSE, are breaking barriers in diversity and inclusion. In 2018, Stacey Cunningham became the first woman president of NYSE – a testament to decades of progress since Muriel Siebert took her seat in 1967. With even more strides taken towards inclusivity by including diverse members based on gender identity or race within their boards, these markets are setting global standards for diversification. This is not just symbolic but crucial for business growth as it fosters innovation and reflects stakeholder diversity.

The Impact of COVID-19 on Stock Exchanges

When the COVID-19 pandemic hit, it didn’t spare any sector. Public markets felt its grip as they were forced to adapt swiftly. The NYSE made a historic move by ceasing to operate its trading floor in the face of COVID-19, setting an example for other exchanges worldwide that followed suit.

On March 23, 2023, this drastic measure was taken due to increasing health concerns over the spreading virus. This wasn’t just a local phenomenon; trading exchanges worldwide followed suit and shifted their operations online.

The Trading Floor Goes Silent

This shift from bustling trade floors filled with shouting brokers making trades through open outcry methods to silent computer screens at home was historic. It marked an abrupt end of an era where traders would physically meet at Broad Street or Wall Street and set rules for buying or selling shares.

Suddenly, all those images we have come across of frantic people waving papers around on the NYSE trading floor became remnants of pre-pandemic times. The temporary closure left these spaces eerily empty, a sight few could ever imagine before.

A Quick Shift To Digital Operations

To keep things running smoothly during this sudden transition period required massive effort behind-the-scenes by both stock exchanges and financial institutions alike. They had been planning for such contingencies long before anyone heard about COVID-19 because they knew that market stability is crucial during volatile times like these. Now more than ever did technology play a pivotal role in maintaining the functionality of these public markets.

The ability to trade stocks online isn’t new. Still, it was never before implemented on such a large scale and so quickly by major exchanges like NYSE or even NASDAQ. As they say, necessity is indeed the mother of invention.

What Did This Mean For Investors?

In times when physical locations were shuttered due to lockdowns and safety measures, this digital shift allowed investors globally continued access to capital markets. The technology helped ensure that no matter where you were in the world during this pandemic period, if you wanted to buy or sell shares – there would be an operational platform ready for your trading needs.

When COVID-19 struck, the stock market faced a seismic shift. The New York Stock Exchange closed its trading floor for the first time in history, setting off a wave of similar closures worldwide. Suddenly, frantic trading floors were replaced by quiet computer screens at home – an unexpected end to an era. Despite this dramatic change, technology played a crucial role in keeping markets stable and operational during these volatile times. As we discovered that necessity truly is the mother of invention.

FAQs in Relation to History of the Stock Market

How did the stock market begin?

The stock market started with the signing of the Buttonwood Agreement in 1792, leading to the creation of the New York Stock Exchange.

Who started the stock market and why?

Alexander Hamilton helped shape policies that led to the establishment of the NYSE. The goal was facilitating the trade of company shares for capital growth.

How old is the oldest stock market in the world?

The Amsterdam Stock Exchange, now Euronext Amsterdam, founded in 1602 is considered as the oldest.

When was the stock market highest in history?

Dow Jones Industrial Average hit its all-time high on November 8th, 2023, reaching over 36k points.

Conclusion

Reflecting on the history of the stock market, we’ve seen its evolution from humble beginnings under a Buttonwood Tree to a complex global network. We’ve traced pivotal moments like Alexander Hamilton’s financial policies, and NYSE’s inception.

We delved into technological innovations that revolutionized trading – from open outcry to electronic systems. We learned about key shifts in response to dramatic crashes, leading to regulatory bodies like SEC.

We celebrated diversity milestones within exchanges, including Stacey Cunningham’s appointment as NYSE president. Lastly, we explored how even pandemics shape markets with COVID-19 prompting unprecedented changes.

This journey not only illuminated past events but also provided valuable insights for future navigation. As you continue your own investment adventures remember: knowledge is power!

Need Help Automating Your Sales Prospecting Process?

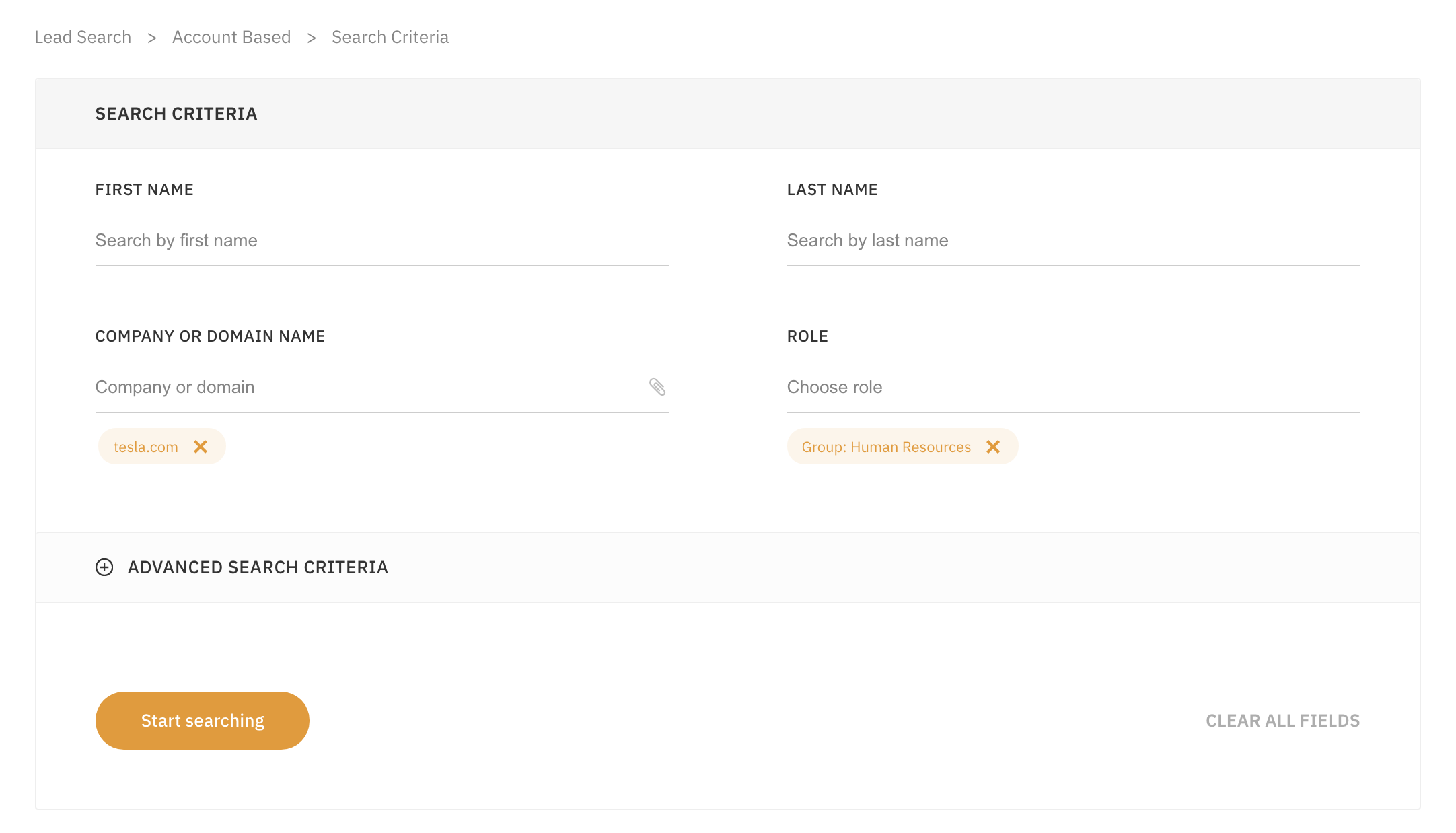

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!