Ever thought about how to invest in AI? Aspiring investors can take the leap into this futuristic technology, as AI is closer than they may think. The rise of artificial intelligence (AI) has opened up new horizons for investors willing to embrace this technological revolution.

The concept is as fascinating as the human brain – complex yet captivating. Envision being part of an area that could possibly alter our universe and form how we exist, labor or even amuse ourselves? That’s exactly what investing in AI can offer you! It’s not just big tech giants leading the way either; there are many smaller companies involved with unique investment strategies creating breakthroughs every day.

You’ll be embarking on an exciting journey through global robotics, cloud computing and machine learning landscapes. However, like any voyage into unknown territory, this adventure involves risk including navigating market conditions

Table of Contents:

- Understanding AI Investments

- Evaluating AI Investments

- Specific AI Investment Options

- Using AI for Investment Decisions

- Risks and Considerations in AI Investments

- Emerging Opportunities in AI Investment

- FAQs in Relation to How to invest in Ai

- Conclusion

Understanding AI Investments

If you’ve ever wondered how to invest in Artificial Intelligence, you’re not alone. The world of AI is complex but also ripe with potential for savvy investors who know where to look.

The Importance of Diversification

Diversifying your investments is a well-established strategy, and it holds true when investing in the rapidly evolving field of AI. It’s all about balancing risks while maximizing potential returns.

Sector funds focusing on AI can offer exposure to this technology without putting all your eggs in one basket. Remember though that these are typically non-diversified funds, so there’s still an element of risk involved as Charles Schwab Investment Management highlights.

Understanding Market Conditions

In any investment decision, understanding market conditions plays a key role. But why does this matter when looking at personalized investment advice? Because market trends can have profound impacts on sectors like the artificial intelligence industry, which continues to shape our future—from self-driving cars to cloud computing.

Evaluating AI Investments

When it comes to AI investments, the name of the game is informed decision-making. Understanding factors like expense ratio, track record, and management team can help steer you in the right direction.

Navigating Market Volatility

In an ever-changing market landscape filled with variables such as geopolitical tensions or global pandemics, market volatility is inevitable. It’s not a matter of if but when these fluctuations will occur and impact your investments.

A successful investor doesn’t panic during times of high market volatility but rather uses this period as an opportunity for potential gains. Remembering that past performance is not a guarantee of future results helps keep emotions at bay and decisions rational.

The key lies in understanding business models within the artificial intelligence industry, which involves assessing how companies generate revenue and profit margins. For instance, does a company specialize in self-driving cars or cloud computing? These nuances can significantly influence its resilience during turbulent times.

Diving Deep into Expense Ratios & Management Teams

Charles Schwab Investment Management, one trusted source among many others reminds us that “Data from third-party providers are obtained from reliable sources but their accuracy or reliability cannot be guaranteed.”

This emphasizes why scrutinizing expense ratios matters when evaluating AI ETFs – higher fees eat into potential profits over time. As we’re all aware (or should be), no investment strategy works without considering costs associated with it.

Make sure to evaluate whether lower-cost funds provide comparable returns before jumping on board.

Also essential are management teams steering these AI companies’ ships – seasoned captains navigating through choppy waters make better bets than greenhorn sailors.

Let’s wrap up by remembering: investing involves risk. AI investing is no exception, but it’s a sector that can offer remarkable returns if you navigate wisely.

Specific AI Investment Options

Let’s delve into some concrete options for investing in artificial intelligence. A viable option for investing in artificial intelligence is through exchange-traded funds (ETFs), which are collections of stocks that track a particular sector. These are baskets of stocks that track a specific sector, and they can be an effective way to spread your risk while still benefiting from growth in the industry.

iShares Robotics and Artificial Intelligence ETF

A top choice among investors is the iShares Robotics and Artificial Intelligence ETF. This fund focuses on companies at the forefront of robotics technology and AI development.

The iShares ETF allows you to invest not only in big tech firms but also emerging players making strides in machine learning, autonomous vehicles, cloud computing applications – all key areas within this wide range of sectors involved with AI technologies.

If we peek under its hood, it’s impressive how diversified this fund really is. It holds 44 individual stocks including household names like Nvidia along with lesser-known innovators such as Intuitive Surgical; thus playing a greater role than just betting on self-driving cars or speech recognition software.

Global X Robotics & Artificial Intelligence ETF (BOTZ)

Global X Robotics & Artificial Intelligence ETF (BOTZ), another solid option, offers similar exposure to the global robotics and artificial intelligence industry by tracking the ROBO Global Index. BOTZ takes things up a notch with holdings ranging across ABB Ltd., Keyence Corp., Fanuc Corp., etc.

These AI ETFs are beautiful because they let investors tap into this thrilling industry. No need to choose individual stocks, which can be tough considering how fast AI is evolving.

Using AI for Investment Decisions

Investing in the stock market is a bit like trying to predict the weather. You can use data, trends, and forecasts, but sometimes it just rains when you least expect it. AI has revolutionized the world of finance, enabling more sophisticated decisions to be made.

The rise of AI tools has made waves in personal finance as well. Think about your own internet searches – are they always purely factual or do you sometimes ask more complex questions? That’s what investing with AI looks like; instead of simple number crunching, these advanced systems can interpret nuanced queries about market data.

Predictive Algorithms in Investing

Predictive algorithms, an essential part of generative AI applications, have begun to revolutionize how we approach investment strategies. They’re designed to analyze vast amounts of historical and real-time information from the stock exchange to forecast future trends with impressive accuracy.

This machine learning ability helps investors view a wide range of possibilities that the human brain alone may overlook. For instance, they might spot emerging patterns across global robotics companies or pinpoint which big tech firms are making significant strides in self-driving car technology – insights crucial for savvy investment decisions.

A common concern among potential users though: “What if I don’t understand all this high-tech jargon?” Fear not. These predictive algorithms are often paired with speech recognition software so you can literally talk through your investments without needing any technical expertise at all.

Tapping Into Diverse Markets With Intelligent ETFs

In addition to individual stocks such as Intuitive Surgical or autonomous vehicle developers, which certainly involve risk including loss due to volatility on account of their speculative nature, you can also consider AI ETFs. Exchange-traded funds (ETFs) like the Global X Robotics & Artificial Intelligence ETF or the iShares Robotics and Artificial Intelligence ETF provide exposure to a broad array of companies involved in AI technology.

By investing mainly in companies set to gain from the growing use of robotics and AI tech, such as Nvidia, this strategy provides a well-rounded portfolio. This diversified approach helps manage risk while aiming for growth.

Investing in AI isn’t just about crunching numbers, it’s like having a smart conversation with the market. Predictive algorithms can analyze vast amounts of data and spot patterns we might miss, guiding savvy investment decisions. Don’t worry if you’re not tech-savvy – voice recognition is here to help. Broaden your portfolio by investing in diverse markets through AI ETFs for managed risk and potential growth.

Risks and Considerations in AI Investments

Investing in the continually changing realm of AI may appear to be a no-brainer. After all, it’s a technology that’s shaping everything from autonomous vehicles to cloud computing. Putting money into AI may seem like a smart move, but there are associated dangers.

The Role of Expert Advice

A critical first step is recognizing when you need help navigating these complexities. Investing involves risk including loss of principal—an understanding necessary for every investor venturing into this arena.

This need for guidance becomes more pronounced considering the limitations inherent within AI technologies themselves—despite their sophistication, they still can’t mimic the intricacies of the human brain completely.

Finding an expert who understands both investing and the nuances of AI technologies can be invaluable here—they could provide advice tailored specifically to your situation and objectives.

Mitigating Market Volatility Risks

Another significant factor affecting your investments is market volatility. The stock exchange doesn’t stand still; prices fluctuate based on myriad influences such as economic trends or company-specific news. Market volatility, especially related to emerging markets where many new tech companies reside, should always be taken into account while making decisions about your portfolio allocation among individual stocks or ETFs focused on specific sectors like AI and robotics.

To mitigate some part of this risk, diversification strategies are crucial – spreading out investments across different assets might help shield against drastic losses if one particular sector faces downturns unexpectedly. Sector funds typically focus narrowly on specific industries and may lack diversification, thus adding an additional layer of risk.

Understanding the Specifics of AI Investments

A deeper understanding of the companies involved in your investments is also essential. Companies that play a greater role in AI development could offer better potential returns. For instance, some firms might focus more on machine learning or big tech innovations; others might invest heavily into developing applications for self-driving cars or other autonomous vehicles.

The bottom line? Just as every stock isn’t a guaranteed winner, not all investments are surefire bets. It’s crucial to remember that patience and due diligence often lead to the best results in the financial market.

Emerging Opportunities in AI Investment

The world of AI investment is bustling with opportunities, particularly from smaller tech companies who are developing innovative technologies. Many investors view these firms as the hidden gems of the industry because they’re often overlooked in favor of big tech giants.

In contrast to larger entities like Google or Microsoft, these emerging players may offer a wider range and more diversified set of investments. These include everything from machine learning applications that replicate complex human brain functions to autonomous vehicles and self-driving cars revolutionizing transportation.

ROBO Global Robotics, an ETF (exchange-traded fund) dedicated to global robotics and automation, provides an interesting snapshot into this landscape. It holds 78 stocks, including top holdings such as Keyence, Intuitive Surgical, Airtac International Group, ServiceNow, and Hexagon AB.

This wide range showcases how diverse the artificial intelligence industry has become – spanning healthcare with surgical robots by Intuitive Surgical to cloud computing solutions provided by ServiceNow.

A word for those new to investing – every venture involves risk including loss of principal invested. That’s why it’s essential you conduct your due diligence before plunging headfirst into any stock exchange transactions involving individual stocks or ETFs.

Diversifying Your Portfolio with AI Investments

One popular approach among seasoned AI investors is diversification through investing in several different sectors within the broad field that constitutes ‘AI’. This can help mitigate some risks associated with investing in just one company or technology niche while providing exposure across a wide spectrum encompassing multiple industries where artificial intelligence plays a greater role.

Exchange-traded funds (ETFs) that focus on AI are a viable option here. For instance, the Global X Robotics & Artificial Intelligence ETF (BOTZ), invests in companies benefiting from increased adoption of robotics and AI technologies, including Nvidia and ABB among its top holdings.

Finding The Hidden Gems

intelligence, don’t forget the smaller players. These nimble startups are making waves with their innovative solutions and disruptive technologies.

Dive into the bustling world of AI investment. Keep an eye out for overlooked smaller tech firms with innovative solutions. Diversify your portfolio by investing across different sectors within AI to mitigate risks and increase exposure. Don’t forget, due diligence is crucial before making any moves in stock exchange transactions.

FAQs in Relation to How to invest in Ai

What is the best way to invest in AI?

Diversify your portfolio with a mix of ETFs, stocks, and bonds from AI-focused companies. Consider market trends and consult experts.

What is the best AI stock to buy?

This can change frequently due to market volatility. Look for stable companies investing heavily in AI like Alphabet, Amazon or Nvidia.

Is AI good to invest in?

AI holds potential as it’s driving innovation across sectors. But be mindful of risks such as market fluctuations and technology limitations.

Where is the best place to invest in AI?

You can use online platforms like Charles Schwab or iShares for diversified exposure via their specialized ETFs focused on robotics and artificial intelligence.

Conclusion

Embarking on the journey of AI investment isn’t a trip to an unknown future, it’s embracing the present. You’ve learned how to invest in AI, from understanding its importance and evaluating potential investments, to navigating market volatility.

You’re now aware of specific ETFs like iShares Robotics and Artificial Intelligence ETF that focus on robotics and AI technologies. Remember how we stressed using predictive algorithms for better decision making?

Risks are part-and-parcel of investing; you can mitigate them with expert advice while focusing on emerging opportunities in smaller tech companies involved in innovative developments.

Your adventure into global robotics, cloud computing and machine learning landscapes begins today. Start small but think big!

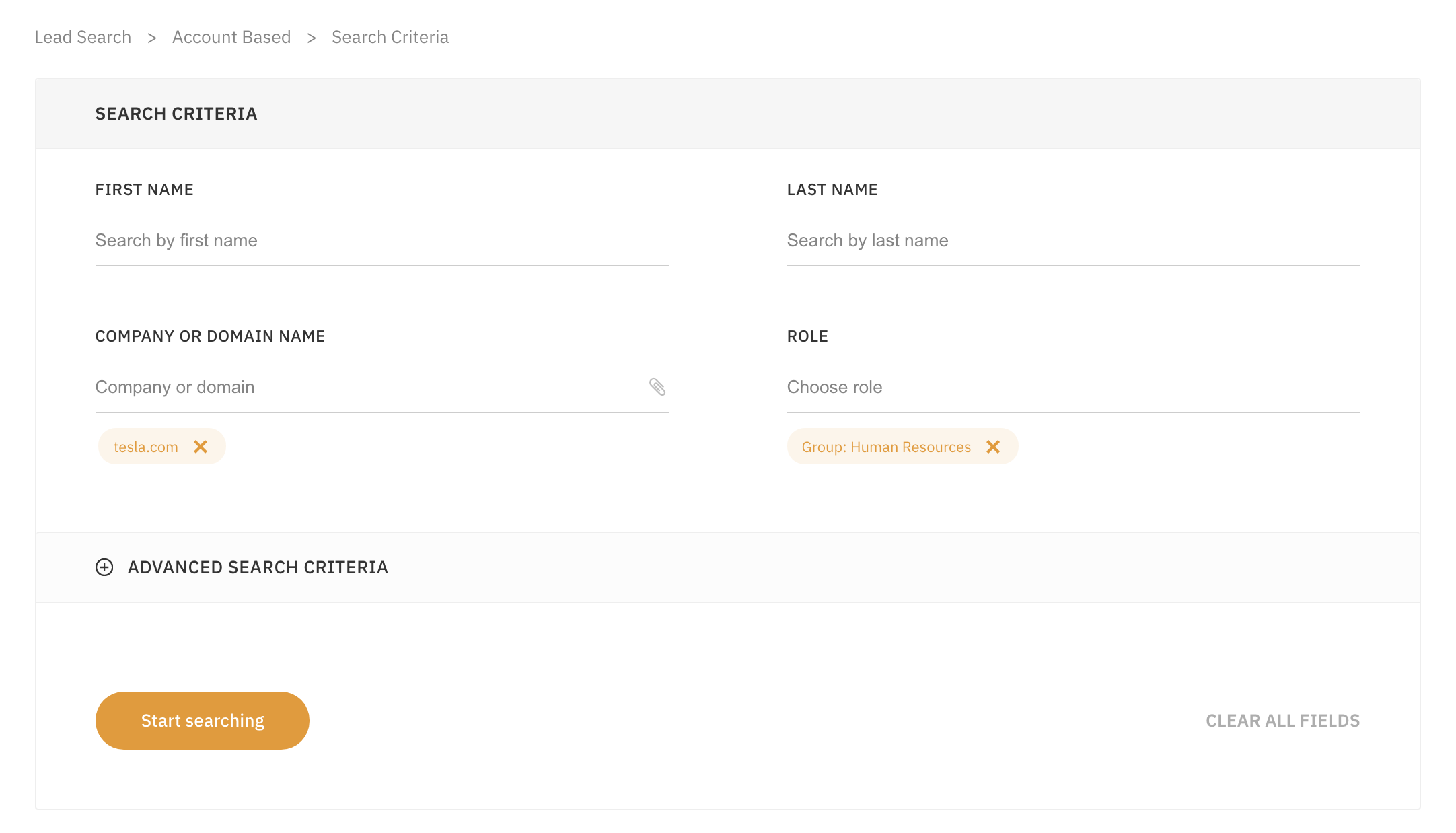

Need Help Automating Your Sales Prospecting Process?

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!