Imagine standing at the edge of a vast financial ocean, toes sinking into the warm sand. You’ve got your trusty surfboard — how to invest. But you’re not sure how to catch that perfect wave that will lead you towards wealth accumulation. Well, it’s good news! This guide is here for exactly that reason.

We all know investing can be intimidating. A swirling mix of numbers and jargon enough to make anyone’s head spin like a Wall Street ticker tape. Yet beneath this seemingly complex surface lie simple principles waiting to help grow your money tree.

This post won’t just give you some dry lecture on mutual funds or stock market investments; no sir! We’ll explore investment strategies from savings accounts right up through high-risk options with potential higher returns if managed well, we’ll touch on retirement accounts benefits too.

Not only that, but you’ll also receive more benefits as we move forward. So stay tuned!

Table of Contents:

- Understanding Investment Basics

- Choosing the Right Investment Accounts

- Exploring Different Investment Vehicles

- Developing an Investment Strategy

- Seeking Professional Guidance

- Tips for Successful Investing

- Understanding and Managing Investment Risks

- Building a Diversified Investment Portfolio

- Unraveling the Mysteries of Investment

- FAQs in Relation to How to Invest

- Conclusion

Understanding Investment Basics

Before you begin investing, it is essential to clearly define your investment objectives. Ask yourself what you hope to achieve financially and in what time frame. Are you aiming to obtain funds for a vehicle, college fees, or your golden years? Defining clear financial objectives is the first step on your journey.

Risk tolerance plays an equally important role in shaping how to invest. Your comfort level with potential losses versus gains should guide your decision-making process. It’s all about striking a balance between risk and reward.

Defining Your Investment Goals

Your financial dreams aren’t just wishful thinking; they’re possible realities if approached correctly. Maybe it’s buying that dream house, taking that long-awaited world trip or achieving comfortable retirement years – no matter the goal, every successful investor has started from this point: defining their targets clearly. Investing style, budget, and risk tolerance are key elements of this phase.

Understanding Risk Tolerance and Time Horizon

A grasp of your risk tolerance can help protect against hasty decisions based on market fluctuations leading to potential losses. A longer time horizon often allows for more aggressive strategies due to more recovery time before funds are needed. This concept aligns closely with Warren Buffett’s advice: “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

Here is a helpful resource exploring these concepts further.

Remember there isn’t one universal approach when learning how-to-invest – everyone’s circumstances differ significantly making each investment journey unique.

Choosing the Right Investment Accounts

When it comes to investing, selecting the right accounts can be as crucial as picking profitable assets. Factors such as tax advantages and intended use play a significant role in this decision.

Exploring Savings and Money Market Accounts

If you’re just starting your financial journey or looking for an easy-access money reserve while earning some interest, savings and money market accounts might suit you best. These are considered low-risk investment options where you can stash about 20% of your income, following a popular guideline for building an emergency fund.

Savings accounts offer secure storage for your funds with relatively higher returns than regular checking accounts. But if you want more flexibility along with slightly better yields, consider opening a high-yield savings account or even exploring brokerage account options.

The advantage of these kinds of investments is their accessibility—you get easy access to withdraw funds whenever needed without facing penalties that usually come from tapping into retirement or other long-term investment accounts early on.

A word of caution though: While they provide safety and liquidity, don’t expect sky-high returns from them. The primary goal here is wealth preservation rather than aggressive growth like we see in stock market investments or mutual funds.

To make sure which type suits you best depends largely on individual circumstances—financial goals, risk tolerance levels—and it’s always a good idea to consult with professionals before making any final decisions.

Exploring Different Investment Vehicles

Dipping your toes into the investment world? Let’s dive deeper. Did you realize mutual funds can buy and trade stocks, bonds, and other holdings?

The profits or losses in investments depend on the purchase price and sale price. This isn’t exclusive to just mutual funds; it applies to individual stocks as well.

Mutual funds, managed by fund managers, pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities.

The Stock Market Adventure

Speaking of stocks, let me tell you: it’s not for the faint-hearted. But that doesn’t mean we shy away from it. Investing in individual companies allows you direct ownership stakes – kind of like owning a tiny slice of Apple (the tech giant) without having to invent anything.

Real Estate – More Than Just Brick And Mortar

Moving beyond Wall Street onto Main Street – Real estate is another popular choice among savvy investors looking for regular income through rental properties or capital gains via property appreciation.

- Rental Properties: It’s simple: buy a property, rent it out, earn monthly income while waiting for its value to appreciate over time.

- Real Estate Investment Trusts (REITs): A fun twist where multiple investors pool their money together to invest in real estates around the globe. Kind of like a mutual fund, but for properties.

Each investment vehicle has its own set of rules and returns, so understanding what suits your financial goals is key to making smart decisions. So buckle up and get ready for an exciting ride on the investing highway.

Developing an Investment Strategy

When it comes to setting financial goals, a clear investment strategy is crucial. It’s like having a roadmap that guides your decisions, helping you avoid costly detours and dead ends.

The Importance of Diversification

Diversification plays a key role in any sound investment strategy. Think of it as not having all your money in one place; rather, you’re spreading it across various investments to reduce risk.

This approach allows for some parts of your portfolio to perform well even if others don’t, offering protection against market volatility. But remember – diversification isn’t just about owning different investments; it’s also about varying the types of investments you hold (like stocks and bonds).

Making Asset Allocation Work for You

Asset allocation, on the other hand, involves dividing your investments among major categories such as cash, bonds or equities depending on factors like age, risk tolerance and long-term objectives.

You might want more stable but lower-yielding options like bonds when nearing retirement while opting for potentially higher returns with equities earlier in life despite their higher risk levels.

Your Budget Matters Too.

Budget considerations are integral too. Before investing, consider what portion of income can be allocated towards investing without hampering daily necessities or emergency funds.

Remember: developing an effective investment strategy requires careful thought around setting financial goals while balancing risks through diversification and appropriate asset allocation. By creating a sound plan, you can be on the right path to achieving your financial objectives.

Seeking Professional Guidance

So, you’re all set to embark on your investment journey. But investing isn’t a walk in the park and sometimes we need a bit of help navigating it. That’s where financial advisors and planners come into play.

A good financial advisor, like Matthew Blume, who happens to be an ace portfolio manager at Pekin Hardy Strauss Wealth Management, can offer valuable insights based on their wealth of experience. They understand market trends better than most folks do with their morning coffee.

Why is professional guidance so crucial?

The world of investments is vast – from mutual funds to individual stocks or even retirement accounts; there are countless options available for investors. With these myriad choices comes complexity – but don’t let that intimidate you. A competent advisor helps simplify this maze by aligning your investment decisions with your long-term goals and personal finance situation.

Your Guide through Market Volatility

No one likes roller coasters when it comes to their money right? However, market fluctuations are part-and-parcel of investing; what goes up must come down (and vice versa.). This fluctuation might make some people anxious about making bad investment calls leading them towards poor financial outcomes.

This is another area where professional advice shines. Advisors guide clients during times of volatility while helping them maintain focus on long-term goals instead getting caught up in short term noise. Their expertise enables beginner investors buy low sell high rather successfully navigate stormy markets without losing sleep over potential losses or capital gains tax implications.

Tailored Investment Strategies

Every investor has unique needs which require personalized strategies – cookie cutter approaches just won’t cut it here. An expert will work closely with you understanding your financial goals, risk tolerance levels and investment style to craft a plan tailored specifically for you. They can help you strike the right balance between higher returns and risk management – because let’s face it – we all want our money grow without undue sleepless nights.

Remember: the best way to wealth accumulation is through informed decisions. And who better than an expert portfolio manager to guide your journey?

Embarking on your investment journey can feel like navigating a maze, but you’re not alone. Financial advisors and planners offer crucial help to decode market trends, aligning your investments with personal goals. They guide through market volatility, helping maintain focus on long-term targets rather than short-term noise. Advisors also craft tailored strategies for each investor’s unique needs balancing higher returns with risk management – the key to informed decisions leading to wealth accumulation.

Tips for Successful Investing

Successful investing is like planting a tree. The sooner you get going, the longer it has to increase. When you start investing early, your money has more time to earn interest, and that interest earns even more over time – this is the power of compounding.

Saving consistently also plays a crucial role in successful investment. It’s just like watering that planted seed regularly, nurturing its growth bit by bit until it becomes a sturdy tree.

Apart from starting early and saving consistently, staying focused on long-term goals can guide your investment decisions towards success. Picture this: Your investments are sailors navigating the choppy waters of financial markets with only one destination – your long-term goals.

The Power of Compounding Interest

Compounding interest is what makes an acorn grow into an oak tree over years without needing further help or attention from us after we plant it.

To put some numbers behind these words; if you invest $1,000 at 5% annual compound interest when you’re 20 years old, by age 60 (40 years later), that sum would have grown to approximately $7,040. Now imagine if there was consistent savings added each month.

Investing allows you to keep pace with inflation and potentially earn compounding interest as well.

Remember not all investments need high risks for high returns. Just like different trees flourish in various climates and conditions – different types of investments suit different risk appetites and financial situations.

Understanding and Managing Investment Risks

In the world of investing, it’s common to hear “higher risk for higher returns”. But what does this mean? It refers to the fact that investments with potentially high returns usually come with a significant amount of risk. This is where understanding your risk tolerance comes into play.

Risk tolerance is essentially how much loss you’re willing to bear in pursuit of potential gains. Some investors are comfortable taking on more risks in exchange for potentially higher returns. Others might prefer safer bets, even if they offer lower yields.

The trick lies not only in knowing your comfort level but also in aligning it with investment strategies that can manage these risks effectively. No need to go for the extreme; there’s always a compromise.

Diversification: Your Best Bet Against Risk

Spread your investments across different asset classes to minimize the potential for severe losses in any one sector. The concept behind diversification is simple – don’t put all your eggs in one basket. By spreading your money across different types of investments (stocks, bonds, mutual funds), you’re less likely to suffer severe losses when one sector performs poorly because other sectors may perform well at the same time.

Hedging: Another Strategy For Risk Management

Apart from diversification, hedging could also help protect against potential losses while still offering opportunities for growth. Hedging involves making an investment designed specifically as insurance against another asset or group of assets falling in value.

To determine what strategy works best for managing your investment risks, consider factors like financial goals and market conditions alongside personal comfort levels towards risk-taking behaviors. Remember, investing isn’t about being fearless; it’s about being wise.

Understanding your risk tolerance is key in managing investment risks. Don’t be afraid to spread your investments across various sectors – it’s a smart way to protect against severe losses. And remember, hedging can also help guard against potential downturns while still providing growth opportunities. Investing isn’t about fearlessness; it’s about wisdom.

Building a Diversified Investment Portfolio

Investing can feel like navigating an unfamiliar landscape. But don’t fret, just think of your investments as a salad bar. Each asset class represents different ingredients that contribute to the overall taste.

Choosing the Right Mix of Assets

Your Asset allocation, or how you distribute your money across various investment types (stocks, bonds, real estate), is akin to picking out items from this salad bar. It’s all about balance.

You wouldn’t want only lettuce in your bowl right? The same goes for investing – diversifying into multiple assets reduces risk and potentially increases returns.

The best part? No single strategy is ideal for everyone; it’s up to you to determine what works best according to your financial goals and risk tolerance. You get to determine what is most effective for you depending on your financial objectives and willingness to take risks.

Picking individual stocks may seem exciting but remember: too much bacon can overpower other flavors in our salad metaphor. Hence, adding mutual funds or ETFs offers broader market exposure with less volatility than owning individual stocks alone. Mutual funds, managed by professional fund managers, are also worth considering because they pool together money from multiple investors to buy a diversified mix of stocks or bonds.

“The four most dangerous words in investing are ‘this time it’s different,'” – said Sir John Templeton. Remember folks, when building portfolios diversity always wins.

Unraveling the Mysteries of Investment

The world of investment might seem like a labyrinth to beginners. But with a little guidance, you’ll soon find it’s not as daunting as it seems.

To start investing, understanding your financial goals is crucial. Are you aiming for wealth accumulation or seeking regular income? Your answer will shape your investment style and strategies.

Different Ways to Grow Wealth

Starting your financial journey with a high-yield savings account can be an ideal way to begin accumulating wealth. It offers easy access money while letting your savings grow over time.

Another way is through mutual funds where fund managers make investment decisions on behalf of investors. They buy stocks or bonds from various companies, providing more diversification and potentially reducing risk compared to individual stock market investments.

Taking Calculated Risks

Risk plays a pivotal role in investing. Higher risk often leads to higher returns but also potential losses. So how do we balance this?

An actively managed portfolio by seasoned professionals like Matthew Blume, senior portfolio manager at Pekin Hardy Strauss Wealth Management could help mitigate these risks while striving for optimal returns.

Finding The Right Advisor For You

Picking the right financial advisor isn’t about finding someone who just manages money well; they should understand you too. Whether that’s Charles Schwab or another firm entirely depends on what services align best with your needs and personal finance philosophy. Here are some tips to help pick out the perfect match.

FAQs in Relation to How to Invest

How do beginners invest?

Start with setting clear financial goals, then learn about different investment options. Start small and gradually increase your investments as you gain confidence.

Is $100 enough to start investing?

Absolutely. Micro-investing apps let you start with little money. It’s not the amount that matters most, but making a habit of consistent investing.

How do I invest my money to make money?

Diversify your portfolio across stocks, bonds, mutual funds or real estate. Stay patient and focused on long-term growth rather than short-term gains.

How much money do I need to invest to make $1000 a month?

This depends on the return rate of your investments. If you average 7% annual returns, for instance, around $172k invested would generate roughly $1k per month.

Conclusion

Investing is a journey, not a sprint. And the good news? You’re already on your way to understanding how to invest.

We’ve demystified investment basics and defined goals. We explored different types of accounts and dove into various investment vehicles.

You now know that diversification reduces risk and how compounding interest can significantly increase returns over time. You also understand why aligning risks with personal comfort levels is crucial for successful investing.

No single tactic is the solution when it comes to investing. So keep learning, stay patient, be consistent – let your money grow at its own pace.

Above all else: start early, save consistently, focus on long-term goals… you’ll ride that wave towards wealth accumulation before you know it!

Need Help Automating Your Sales Prospecting Process?

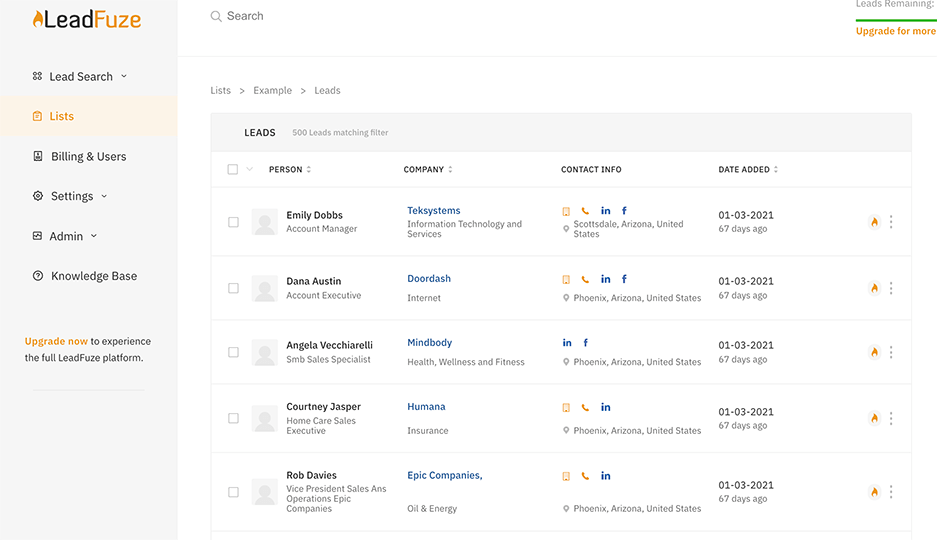

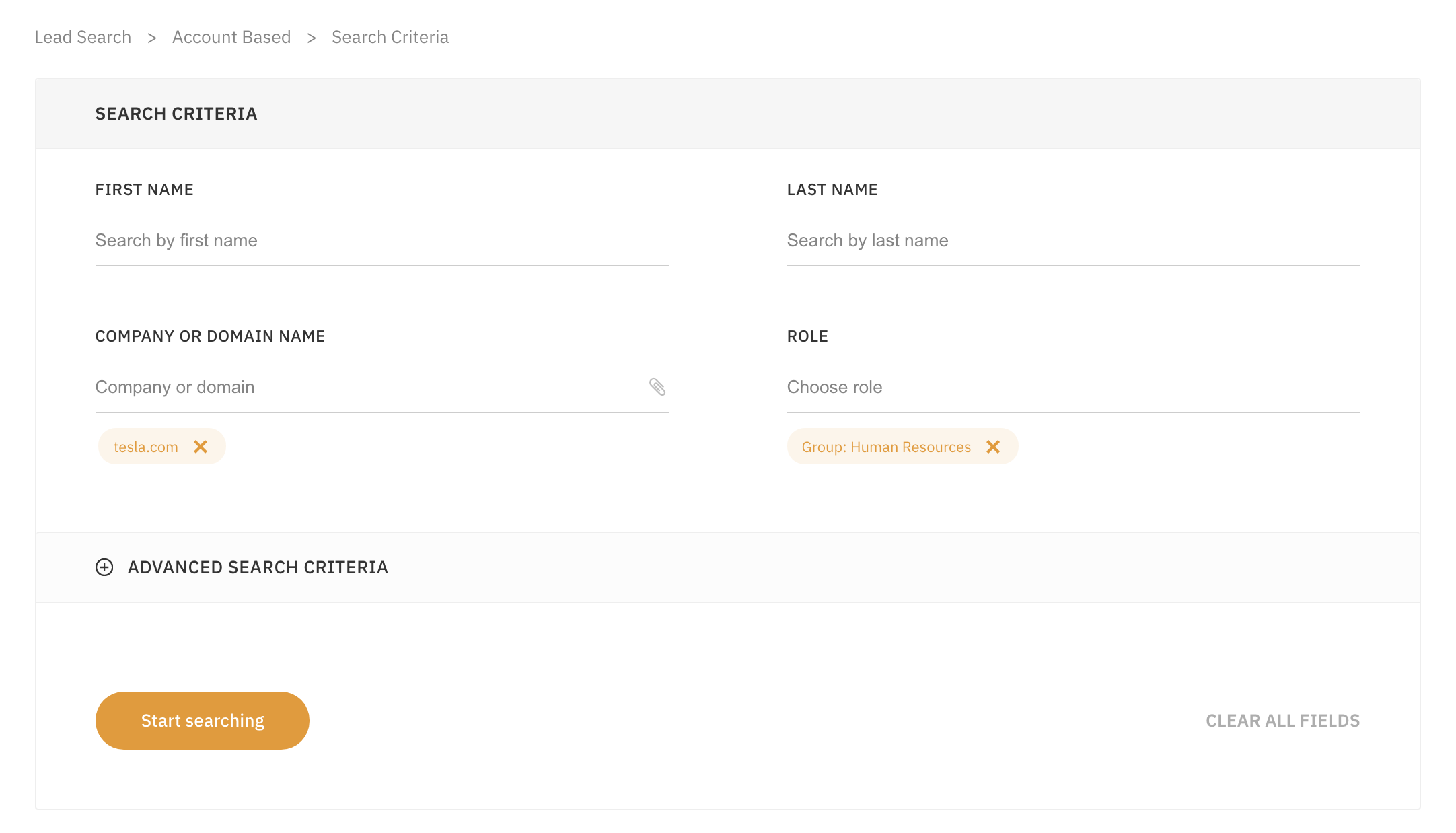

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!