Whether you’re a small business owner, an eCommerce entrepreneur, or a marketing professional, understanding how to calculate lifetime customer value is crucial for your success. According to studies, maximizing the value of existing customers can increase profits by up to 95%.

This statistic underscores the importance of not just acquiring new customers but also nurturing and retaining existing ones. How can you determine this key statistic with all the data and metrics available now?

In this blog post we will delve into the concept of Customer Lifetime Value (CLV), why it’s essential for your business strategy and provide step-by-step guidance on how to calculate lifetime customer value.

We’ll explore different calculation methods from simple averages to more complex predictive models that take into account factors like churn rate and discount rates. So let’s get started!

Table of Contents:

- Understanding Customer Lifetime Value (CLV)

- The Importance of Calculating Customer Lifetime Value

- How to Calculate Customer Lifetime Value

- Predictive vs Traditional Customer Lifetime Value Calculation

- Using Your Customer Lifetime Value Calculations Strategically

- Tips To Increase Your Average Customer Lifespan

- FAQs in Relation to How to Calculate Lifetime Customer Value

- Conclusion

Understanding Customer Lifetime Value (CLV)

The concept of customer lifetime value, or CLV, is a critical metric for businesses.

This measure indicates the total revenue that your business can expect from a single customer account throughout the duration of their relationship with you.

A key component to understanding this value lies in considering not only what customers spend but also predicting an average customer lifespan within your company’s ecosystem.

underscores one crucial point: acquiring new customers typically costs five times more than retaining existing ones.

This fact alone highlights why it’s so important to focus on improving both our customer retention rates and overall experience.

We need strategies designed specifically around encouraging repeat business, fostering loyalty among our most valuable customers.

In essence, we should be aiming to extend each individual’s expected lifespan as part of our brand community.

Next up – let’s delve into why calculating CLV matters so much for any successful marketing strategy.

The Importance of Calculating Customer Lifetime Value

Understanding the importance of measuring customer lifetime value is a game-changer for businesses.

This key metric helps to identify your most valuable customers, allowing you to tailor offerings and improve customer loyalty effectively.

It emphasizes that by calculating CLV, companies can reduce their overall marketing expenses.

A focus on improving customer retention rates, rather than solely investing in new customer acquisition costs, often results in higher profitability.

Fostering Business Growth Through CLV Calculation

Determining how much an average customer spends over their expected lifespan with your brand gives insight into total revenue potential from each client relationship.

This data enables strategic allocation of resources towards retaining existing customers who contribute significantly more to business earnings.

A study by Harvard Business Review reveals that increasing CLV increases profits anywhere from 25% up to a staggering 95%.

Leveraging CLV For Enhanced Customer Experience And Loyalty Programs Designing

Calculating the average sale per transaction or purchase frequency allows you not only to understand buying habits but also to predict future behavior patterns. This knowledge can be used as leverage when designing personalized experiences or launching targeted loyalty programs.

The goal here is simple: encourage repeat business while simultaneously fostering stronger relationships between brands and loyal customers.

By understanding which segments yield high returns over time (CLTV), marketers gain insights needed to make smart decisions about where to invest efforts to maximize ROI long term – ultimately leading to improved company-wide performance across all levels of operations, including sales and service departments alike.

How to Calculate Customer Lifetime Value

Understanding how to calculate customer lifetime value (CLTV) is essential for every business.

This metric provides insights into the average revenue your company can expect from a single customer account during their relationship with you.

Calculating Company-Level CLV

To calculate CLV at a company level, start by determining the average purchase value and frequency of your customers’ purchases.

Multiply the average purchase value and frequency of customer purchases to obtain total annual revenue per individual. Example.com provides helpful guidance for computing CLV on a company-wide basis and at the segment level.

Calculating Segment-Level CLV

You can also measure customer lifetime at a segment level. This involves grouping similar customers based on characteristics like demographics or buying behavior, then calculating their respective averages for purchase values and frequencies.

The Neil Patel blog post about segmentation strategy, example.com, explains it in detail.

Calculating Individual-Level CLV

To determine individual-level CLV, consider specific consumer behaviors such as repeat business patterns or responses to loyalty programs. A tool like example.com, which specializes in behavioral analytics, could be useful here.

In essence, understanding each aspect of measuring client lifespan helps improve overall retention rates while reducing acquisition costs. In turn, that improves profitability over time since loyal clients typically spend more than new ones – leading us onto our next discussion point: predictive vs traditional methods of calculation.

Predictive vs Traditional Customer Lifetime Value Calculation

When it comes to measuring customer lifetime, businesses have two primary methods: predictive and traditional.

The predictive approach utilizes AI-driven models to anticipate customer behaviors, based on past data.

This method factors in churn predictions for more accurate forecasts of how long customers will stay with your brand and how much they’re likely to spend during their expected lifespan.

Traditional CLV Calculation Method

In contrast, the traditional way of calculating CLV is a bit simpler but less dynamic. It involves using historical aggregate data such as gross margin per lifespan, retention rate, and discount rate.

-

Gross Margin Per Lifespan – This refers to the total profit that a business earns from an average customer over their entire relationship period after deducting direct costs associated with serving them.

-

Retention Rate – The percentage of customers who continue doing business with you over time compared against those who stop.

-

Discount Rate – A financial concept used in cash flow analysis which considers that money available now is worth more than the same amount in future due its potential earning capacity.

Differences Between Predictive And Traditional Methods Of Calculating Clv

-

Precision: While both approaches can provide useful insights into your valuable customers’ behavior patterns; predictive models generally offer higher precision because they use advanced statistical techniques.

-

Data Requirements: Predictive modeling requires detailed transaction-level data while traditional calculations can be performed using summary statistics at cohort or segment level.

-

Tactical Versus Strategic Use Cases: With its forward-looking nature, predictive CLV calculation could help guide strategic decisions like budget allocation across different marketing channels. In contrast, if the aim is simply to comprehend what occurred in the past (e.g., which strategies were most successful), then traditional CLV computation could be enough.

Key Takeaway: Predictive customer lifetime value (CLV) calculation uses machine learning algorithms to predict future behaviors, providing more accurate forecasts. Traditional CLV calculation is simpler but less dynamic, using historical aggregate data. Predictive models offer higher precision and require detailed transaction-level data, while traditional calculations can be performed with summary statistics. Predictive CLV is useful for strategic decision-making, while traditional CLV suffices for understanding past performance.

Using Your Customer Lifetime Value Calculations Strategically

Once you’ve calculated your customer lifetime value (CLV), the next step is to use this data strategically. By comprehending the amount each customer contributes to your total income, you can make decisions about advertising costs, client procurement expenses, and other strategic investments based on informed knowledge.

Leveraging CLV for Marketing Optimization

The average sale per existing customer provides a benchmark for determining reasonable marketing spend. Knowing the expected lifespan of customers helps in allocating resources effectively across different channels or campaigns.

This approach ensures that every dollar spent on advertising yields maximum return by targeting valuable customers who are likely to bring repeat business.

Predicting and Reducing Churn Rates

A higher CLV often indicates improved customer loyalty which translates into lower churn rates. But it’s not enough just to calculate CLV; businesses should also track changes over time using tools like cohort analysis.

If there’s an unexpected drop in CLV among certain cohorts or segments, it could signal rising churn rates requiring immediate attention from your team.

Finding Experience Gaps with High Costs

(CX) plays a significant role in maintaining long-term relationships with clients. By correlating CX metrics such as Net Promoter Score(NPS) with individual-level CLVs, companies can identify costly gaps where improvements might significantly boost retention.

Growing Business Earnings Through New Experiences Design

Innovative experiences have proven effective at increasing both initial sales and encouraging repeat purchases. For instance, programs may increase conversion rates while subscription services encourage ongoing engagement.

To learn more about these strategies check out resources provided by experts like [Expert Name].

Tips To Increase Your Average Customer Lifespan

Enhancing your average customer lifespan requires strategic efforts in various areas of your business.

The key is to focus on delivering exceptional value and fostering a solid business relationship with each existing customer, which can significantly improve customer retention rates.

Building A Loyalty Program

A well-structured loyalty program can encourage customers to become repeat buyers, thereby increasing their expected lifespan with your brand. Forbes Business Development Council highlights the effectiveness of such programs for businesses aiming at improving their average lifetime value per client.

Loyalty programs not only incentivize purchases but also enhance overall customer experience by making customers feel valued and appreciated. This sense of appreciation encourages them to remain loyal over time.

Providing Exceptional Customer Support

In an era where consumers have countless options available at their fingertips, providing top-notch customer support has never been more critical for retaining valuable customers and extending their average lifetime with your brand. SuperOffice’s research study demonstrates how excellent service leads directly to increased loyalty among clients.

To provide stellar support consistently:

- Create multiple channels through which clients can reach out when they need assistance or information about products or services you offer,

- Promptly respond to queries raised by users,

- Show empathy towards any issues experienced by patrons using effective communication skills that make them feel understood and respected as part of the solution process,

- Last but not least: Continuously train all team members handling consumer interactions so they’re equipped adequately handle different scenarios effectively while maintaining high levels of professionalism throughout conversations held between themselves and potential clientele alike.

FAQs in Relation to How to Calculate Lifetime Customer Value

What is the best way to calculate customer lifetime value?

The most effective method involves using data on average purchase value, frequency, and lifespan. You then multiply these figures to determine your CLV.

How do you calculate LTV lifetime value?

LTV is calculated by multiplying the average purchase value by the average purchase frequency rate and then by the average customer lifespan.

How do you calculate customer lifetime years?

To estimate a customer’s lifetime in years, analyze their buying patterns over time. Look at when they first became a client and how often they make purchases.

Conclusion

Calculating lifetime customer value is no longer a puzzle. :bulb:

You’ve now mastered the concept and its importance in business strategy.

From understanding the basics to diving into predictive models, you’re equipped with all the tools necessary for accurate calculations.

The power of this metric lies not just in knowing it but using it strategically. :dart:

It’s your secret weapon for optimizing marketing spend, reducing churn rates, identifying costly experience gaps, and designing new experiences that grow earnings.

Your journey doesn’t stop here though! The path to improving average customer lifespan awaits exploration.:footprints:

Loyalty programs? Exceptional support systems? They are all part of this exciting adventure.

Congratulations on unlocking one more key to successful business management!

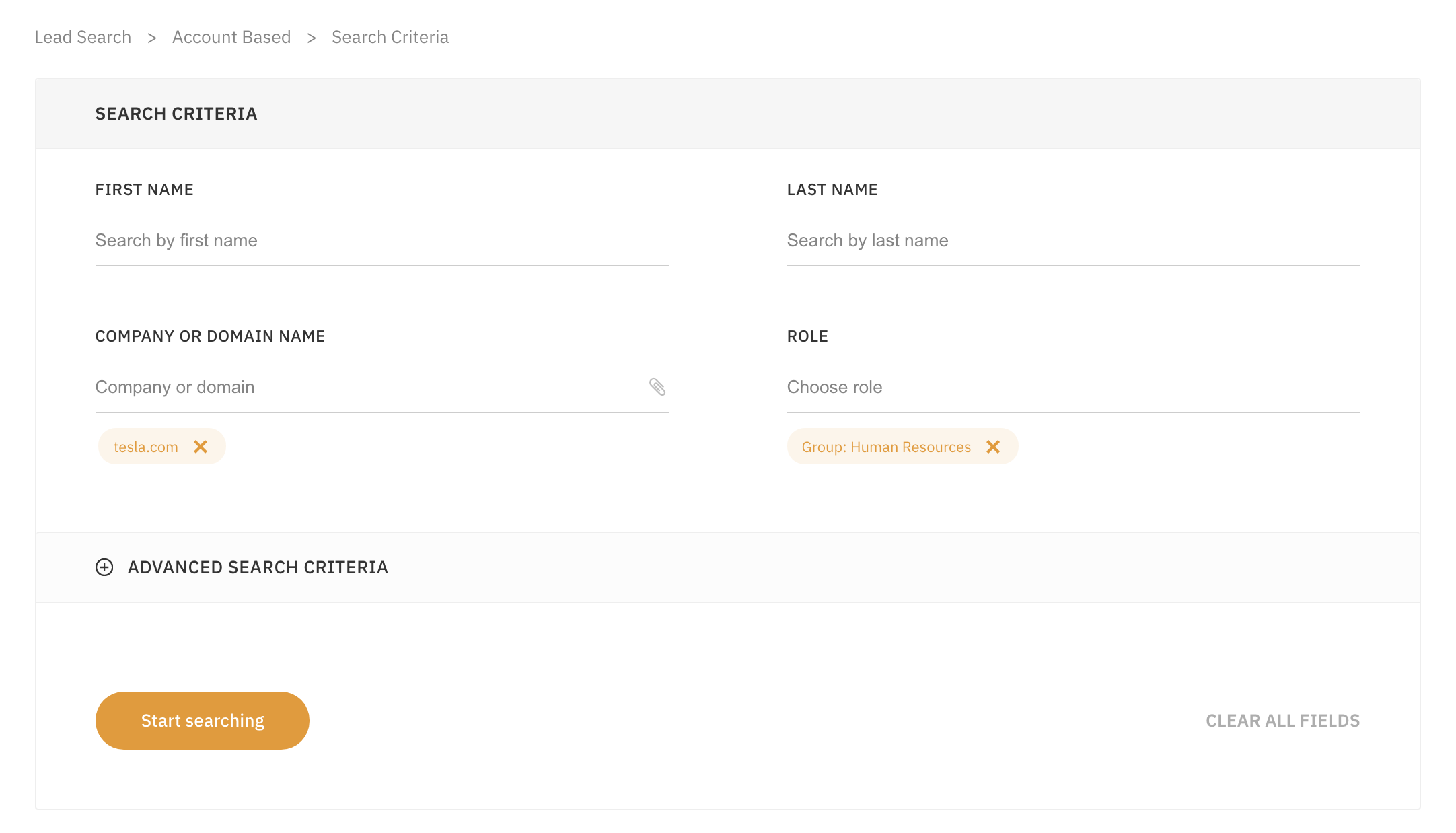

Need Help Automating Your Sales Prospecting Process?

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!