Optimizing Your Insurance Agency Website: A User-Friendly Experience

Let’s get down to business.

Your insurance agency website is the digital face of your company, and you want it to make a great first impression. Here are some essential tips for creating an attractive, user-friendly site that converts visitors into clients:

Mobile Optimization for Seamless Browsing on Smartphones and Tablets

In today’s fast-paced world, over 50% of web traffic comes from mobile devices. To ensure potential clients can easily navigate your site while on-the-go, invest in responsive design or choose a mobile-friendly template.

Clear Navigation Structure to Help Users Find Relevant Information Quickly

Organizing your website in an orderly fashion can help visitors find the information they seek without becoming overwhelmed. Create distinct sections dedicated to different types of insurance products you offer (e.g., auto, home) and add clear call-to-action buttons encouraging users to request quotes or schedule consultations with agents.

Showcasing Customer Testimonials That Highlight the Benefits of Working With Your Agency

Nothing speaks louder than happy customers. Proudly display testimonials from satisfied clients on your homepage or create a dedicated reviews section as social proof that working with your agency is worth it.

Remember, a well-designed and optimized website is the foundation of any successful digital marketing strategy for your insurance agency. Now that you’ve got the fundamentals in place, explore other options for effectively promoting your company on the web.

Harnessing Social Media Platforms

Social platforms like Facebook and Twitter are powerful tools to keep your insurance agency top-of-mind when potential clients search for insurance options.

To make the most out of it, let’s break down some strategies:

Choosing the Right Platform(s) Based on Target Audience Preferences

Step #1: Identify where your audience hangs out online. Is it Facebook? LinkedIn? Instagram?

Step #2: Focus on those platforms that align with your target demographic and business goals.

Strategies for Creating Engaging Content Tailored to Each Platform

Actionable Tip #1: Share valuable content such as slideshows, podcasts, or webinars showcasing your expertise in the insurance industry.

Actionable Tip #2: Post regularly. Staying consistent is a must for establishing an effective presence on any platform.

Bonus Tips.

- Create eye-catching visuals that stand out in users’ feeds – think infographics or quote images related to insurance topics.

- Showcase customer success stories – highlight how you’ve helped people find their perfect policy.

- Avoid over-posting promotional content; instead, focus on sharing helpful tips and advice relevant to your audience’s needs.

- Tailor each post according to its platform: use hashtags wisely on Twitter and Instagram while keeping LinkedIn posts more professional and informative.

By employing these tactics, you can easily capitalize on the potential of social media for your insurance business.

Want more tips on insurance marketing? Check out LeadFuze’s lead generation and sales prospecting software.

Now, go forth and conquer the world of social media marketing.

Implementing Search Engine Optimization (SEO)

Did you know that 75% of users never scroll past the first page of search results? That’s why investing in SEO services is crucial for your insurance agency to stand out.

On-page optimization techniques, including keyword research and meta tags

First up: on-page optimization.

This involves tweaking elements on your website to improve its visibility on search engines like Google.

Step #1: Conduct thorough keyword research to identify relevant terms potential clients might use when searching for insurance options.

Step #2: Incorporate these keywords into strategic areas such as title tags, headings, and content body without overdoing it (a.k.a. keyword stuffing) – moderation is key.

Off-page strategies, such as link building and local citations

Moving onto off-page optimization…

This refers to actions taken outside of your website that impact its rankings within search engine results pages (SERPs).

- Create high-quality backlinks:

- – Guest post on reputable industry blogs or websites;

- – Engage with influencers or partner with complementary businesses;

- Build local citations:

- – Claim your business on Google My Business, Yelp, and other relevant directories;

- – Ensure consistent NAP (Name, Address, Phone) information across all listings.

By implementing these SEO strategies for your insurance agency, you’ll be well on your way to increasing visibility and attracting more clients.

Explore the depths of SEO. Check out this comprehensive guide from Moz.

Pay-per-click (PPC) Advertising Campaigns: Stand Out from the Crowd

Are you ready to take your insurance agency’s online presence up a notch?

Let me introduce you to the world of Pay-Per-Click (PPC) advertising campaigns.

This powerful marketing tool can help you stand out among competitors and drive targeted traffic towards specific insurance products or services.

Identifying High-converting Keywords Relevant to the Insurance Industry

The first step in creating an effective PPC campaign is identifying high-converting keywords relevant to the insurance industry.

You’ll want to use tools like Google Keyword Planner or Ahrefs’ Keywords Explorer for this task.

Dig deep into search trends, analyze competitor performance, and find those golden nuggets that will bring potential clients right to your doorstep.

Effective Ad Copywriting Tips Designed Specifically for Promoting Insurance Offerings

A successful PPC ad isn’t just about choosing the right keywords – it also requires compelling copywriting skills.

- Create attention-grabbing headlines that pique curiosity and encourage clicks.

- Showcase what sets your insurance offerings apart from others with clear value propositions.

- Add a sense of urgency by using phrases like “limited time offer” or “act now.”

Don’t forget to include a strong call-to-action (CTA) that guides users towards the desired outcome, whether it’s requesting a quote or contacting your agency.

By implementing these strategies and partnering with an experienced digital marketing agency, you’ll be well on your way to maximizing the potential of PPC advertising for your insurance agency.

Now go out there and make those clicks count.

Networking Events & Community Sponsorships: Boost Your Insurance Agency’s Visibility

Let’s face it.

In the digital age, traditional marketing methods often take a backseat. However, networking events and community sponsorships are still powerful tools for insurance agencies to gain exposure and build relationships with potential clients.

Strategies for Maximizing Networking Opportunities

First things first, identify local networking events relevant to your target audience and the insurance industry. Meetup.com, Eventbrite, and your local Chamber of Commerce are great places to start searching for these opportunities.

- Always carry business cards with you – you never know who you might meet.

- Create an elevator pitch that succinctly highlights what sets your insurance agency apart from competitors.

- Follow up promptly after meeting new contacts by connecting on LinkedIn or sending a personalized email.

Identifying Local Events and Organizations to Sponsor

Sponsoring community events not only raises brand awareness but also demonstrates your commitment to giving back locally. It’s a win-win situation.

- Browse social media groups or online forums specific to your area in search of sponsorship opportunities.

- Contact non-profit organizations directly; they’re often eager for support from businesses like yours.

- Prioritize sponsoring causes aligned with the values of both your insurance agency and its clientele.

To sum it up, don’t underestimate the power of face-to-face interactions and community involvement when marketing your insurance agency. By combining these traditional methods with digital strategies, you’ll be well on your way to a comprehensive marketing plan that drives results.

Utilizing Dedicated Iovox Numbers for Insurance Agency Marketing

Iovox Numbers can help you optimize your insurance agency’s marketing strategy and improve lead conversion rates in today’s competitive insurance market.

iovox Numbers are a game-changing tool that provide valuable insights on your inbound calls, such as call status and duration. Utilizing the data gathered from Iovox Numbers, you can assess how successful your campaigns have been and make informed decisions about where to best invest.

So, how can you implement iovox Numbers within your marketing strategy?

- Step #1: Choose dedicated iovox numbers for each marketing channel, such as online ads or print materials.

- Step #2: Create unique tracking URLs using these numbers to monitor which channels are driving the most leads.

- Step #3: Analyze collected data regularly to identify trends or areas needing improvement.

The bottom line is that dedicated iovox numbers offer an actionable way to turn phone calls into golden opportunities for revenue growth, giving your insurance agency the edge it needs to succeed.

Don’t wait any longer to start harnessing the power of iovox Numbers. Implement them into your marketing strategy today and watch your lead conversion rates soar.

For more insurance marketing strategies and ideas, check out our blog at LeadFuze. We cater to sales reps, recruiters, startups, marketers, and small business owners in the insurance industry and offer tips on acquiring customers, targeting potential clients, and improving the customer experience. From email marketing to social media marketing, PPC ads to content marketing, we’ve got you covered.

Remember, happy customers are the key to a successful insurance business. Purchase insurance leads and products with confidence, knowing that your marketing efforts are backed by iovox Numbers and a solid marketing plan that aligns with your marketing goals and target audience.

Content Creation & Encouraging Customer Reviews: The Winning Combination

To keep your insurance agency at the forefront of potential clients’ minds, you need to create engaging and informative content. This is where insurance marketing strategies come into play.

But how do you achieve that perfect blend of wit and wisdom?

Ideas for Engaging Blog Topics Relevant to Insurance Consumers

Fear not. We’ve got some killer ideas to get those creative juices flowing:

- Insurance trends and industry news

- Tips on choosing the right coverage for different life stages

- Case studies showcasing real-life claims experiences (with permission, of course)

- Guides on understanding policy terms and conditions

- The importance of having adequate insurance coverage in a rapidly changing world

Incentive Programs Designed Specifically Around Encouraging Customer Feedback

Your existing customers are your best advocates. Leverage their positive experiences by encouraging them to leave reviews online – this will help boost your credibility among potential clients.

- Create an easy-to-use review platform on your website or direct customers towards popular review sites like Google My Business or Yelp.

- Offer incentives such as discounts on future premiums or gift cards to local businesses for customers who leave reviews.

- Send personalized follow-up emails after a claim has been settled, asking for feedback and gently nudging them towards leaving a review.

Combine these marketing tactics with your top-notch content creation efforts, and you’ll be well on your way to acquiring customers and growing your insurance agency.

FAQs in Relation to How to Market an Insurance Agency

What is the best way to market an insurance company?

The most effective marketing strategy for an insurance agency includes optimizing your website, harnessing social media platforms, implementing SEO techniques, running PPC advertising campaigns, participating in networking events and community sponsorships, utilizing dedicated iovox numbers for tracking purposes, creating valuable content, and encouraging customer reviews. Each of these components should be tailored to your target audience’s preferences.

How can I improve insurance marketing?

To enhance your insurance marketing efforts:

- Optimize your website with a clear navigation structure and mobile-friendly design;

- Choose relevant social media platforms based on audience preferences;

- Implement on-page and off-page SEO strategies;

- Run targeted PPC campaigns with high-converting keywords;

- Attend networking events and sponsor local organizations;

- Utilize iovox Number analytics for tracking performance.

What is marketing for an insurance company?

Marketing for an insurance company involves promoting its products or services to potential clients using various channels such as websites, social media platforms, search engine optimization (SEO), pay-per-click (PPC) advertising campaigns, networking events, and community sponsorships. The goal is to increase brand awareness among consumers while generating leads that convert into sales.

How do I attract an insurance agent?

Attracting top-tier agents requires offering competitive compensation packages along with comprehensive training programs. Additionally, showcasing a supportive work environment, providing access to cutting-edge technology tools like CRM systems or lead generation software like LeadFuze, and having a strong company culture can help entice agents to join your agency.

Conclusion

By implementing these marketing tactics, you can increase your agency’s visibility and attract more leads. Keep in mind that it’s important to tailor your marketing strategies to your specific business goals and target audience needs.

For call analytics providers like iovox, visit their website https://www.iovox.com/.

Need Help Automating Your Sales Prospecting Process?

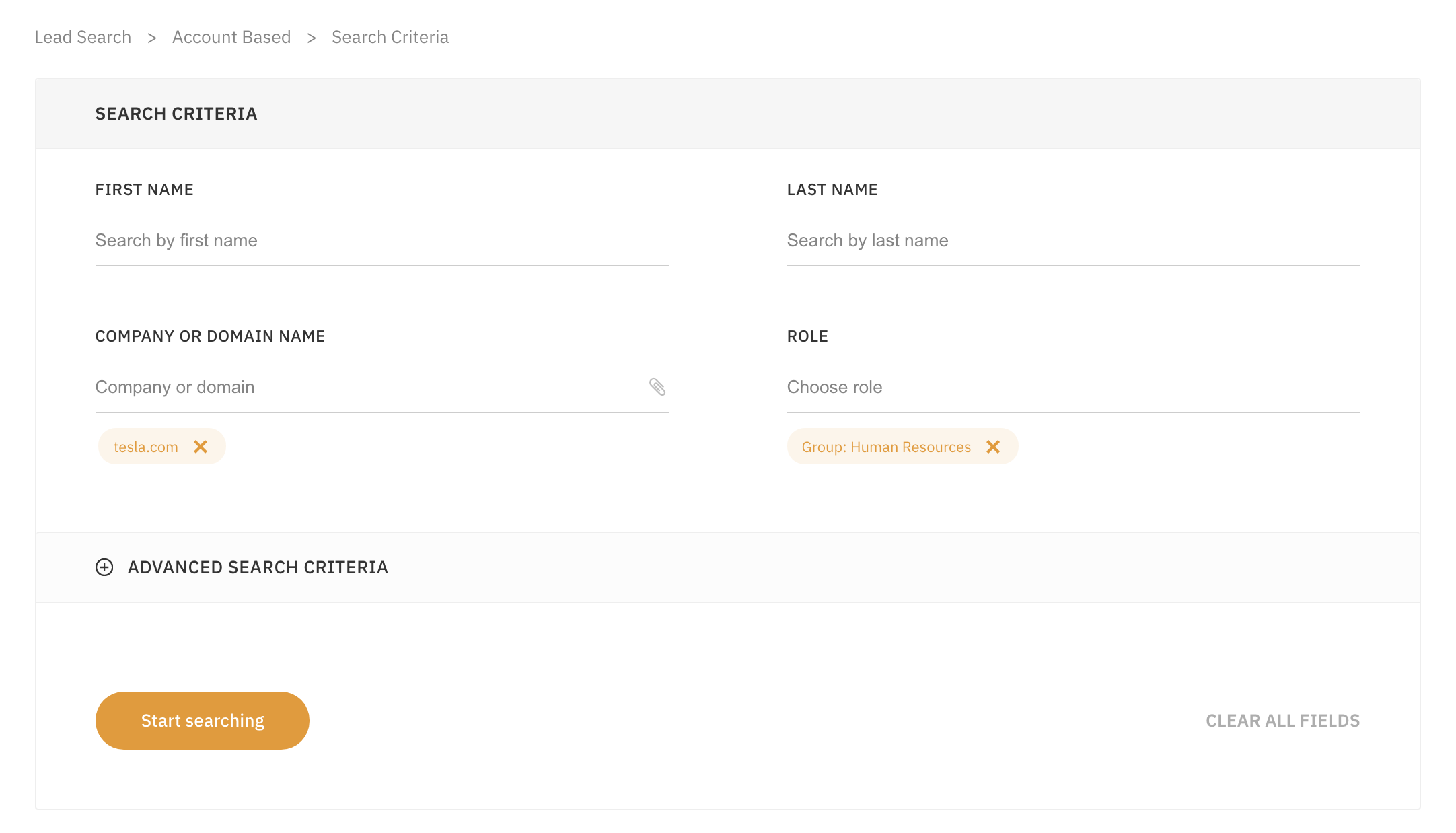

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Just to give you an idea. 😀

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!