Ever stood at the edge of a cliff, gazing down at an ocean of possibilities? That’s how it feels to dive into the world of investment strategies. It can be daunting but exhilarating all at once. You might have dipped your toes in before, maybe bought a stock or two on a friend’s recommendation. Let me tell you – there’s a wealth of potential waiting to be tapped.

This journey we’re about to embark on isn’t just for those with finance degrees or Wall Street dreams. No, this is for anyone ready to seize control over their financial future and turn goals into realities.

Let’s plunge into the particulars of both short-term and long-term investments, plus different real estate investment techniques. We’ll also talk about how to manage risk in your strategy. And here’s the best part: we’re going to break it down into simple, practical steps that are easy to follow – no MBA required!

Table of Contents:

- Understanding Investment Strategies

- Types of Investment Strategies

- Factors to Consider in Investment Strategies

- Real Estate Investment Strategies

- Diversification in Investment Strategies

- Implementing Investment Strategies

- Managing Risk in Investment Strategies

- Long-Term Investment Strategies for Beginners

- FAQs in Relation to Investment Strategies

- Conclusion

Understanding Investment Strategies

Investment strategies are like a roadmap for your financial journey. They direct you on where to allocate your funds, when, and why. Approximately 50% of US citizens employ some type of investment approach.

In essence, an investment strategy is all about long-term investments that help grow wealth steadily over time. This includes stocks or bonds held for long periods that deliver consistent returns.

The beauty of these strategies lies in their flexibility. No single approach is suitable for everyone. Your chosen method could be as unique as you are – focusing on growth investing or income investing depending upon your risk tolerance and retirement goals.

Diving Deeper into Long-Term Investments

If we take a closer look at long-term investments, it’s clear they’re not just about holding onto shares for years hoping their value goes up (although that can certainly be part of it.). It’s more nuanced than this because these types of investments often involve regular contributions to portfolios such as retirement accounts with varying degrees of risks and rewards involved based on market performance.

This concept forms the basis behind popular methods like dollar-cost averaging where investors buy assets at regular intervals regardless if share price appears high or low during each purchase period; effectively spreading out risk over longer durations thereby potentially maximizing long term returns while minimizing potential losses from any short term volatility in prices.

A common misconception people have is thinking only rich folks need an investment strategy but this couldn’t be further from truth. In fact even average earners can benefit immensely by setting aside small amounts regularly towards growing diversified portfolios consisting different types asset classes including equities, fixed income securities etcetera so don’t hesitate start planning now.

Investment strategies are your financial roadmap, guiding you on how and when to invest. They’re all about long-term wealth growth with flexibility in methods tailored to your risk tolerance and goals. Long-term investments aren’t just holding onto shares but also making regular contributions towards diversified portfolios like retirement accounts using methods such as dollar-cost averaging for potential maximum returns. Remember, it’s not only the rich who benefit from investment planning; average earners can grow their wealth by investing small amounts regularly.

Types of Investment Strategies

Investment strategies are like GPS for your financial journey. They guide you towards your investment goals and help you navigate the complex terrain of the stock market. Six main approaches to investing exist, such as growth investing, income investing, active investment, passive investment and buy-and-hold.

Growth Investing: This is a popular strategy that involves buying stocks in companies expected to grow at an above-average rate compared to other businesses on the market. It’s akin to planting seeds today with hopes for big trees tomorrow.

Income Investing: Income investors buy common income investments like dividend stocks because they provide regular payouts – it’s similar to getting rental income from real estate properties. The focus here is not necessarily on share price appreciation but more on generating steady revenue over time.

Short-Term vs Long-Term Investments

A key decision when choosing investments is deciding between short-term and long-term opportunities – much like deciding if you’re running a sprint or a marathon. Short-term trading often means taking advantage of small fluctuations in share price appears whereas long term usually refers focusing more underlying business performance and less about immediate stock prices.

Dollar-cost averaging can be beneficial especially for long-term investors as this strategy involves regularly buying shares at regular intervals regardless of their current cost which might result in good returns over longer periods given sufficient time horizon due factors such inflation risk premium among others explained here.

The Role Of Financial Advisors In Choosing An Investment Strategy

An important factor while determining one’s investment strategy could be working with qualified financial advisors who understand various portfolio objectives & risks associated with different asset classes hence helping tailor a suitable plan based on investor-specific needs preferences available resources just like how a personal trainer would customize a fitness regime according to an individual’s health condition and body type.

This helpful guide provides an in-depth look at various investment strategies. Remember that investing involves risk and your strategy should align with your personal tolerance for it. It’s all part of the journey to achieving long-term returns.

Think of investment strategies as your financial GPS, guiding you towards goals through the complex stock market landscape. Whether it’s growth investing for future prosperity or income investing for regular payouts, each strategy has its merits. Deciding between short-term and long-term investments is like choosing a sprint or marathon pace – both have their places in different scenarios. A skilled financial advisor can help tailor an ideal plan just like a personal trainer customizes fitness regimes to individual needs. And remember: risk is part of the journey.

Factors to Consider in Investment Strategies

Your investment strategy isn’t just about the potential return. It’s also a reflection of your personal financial goals and risk tolerance.

The first factor you should consider is your investment objectives. These are specific, measurable targets that help guide your investing decisions. Whether it’s saving for retirement or accumulating wealth for future generations, knowing what you want from your investments can inform the types of assets you choose.

Risk tolerance is another key aspect to take into account. Every investment comes with some level of risk – this could be due to market volatility or changes in share price among other things. However, not all risks are equal nor do they affect every investor equally so understanding how much uncertainty you’re comfortable with will go a long way towards crafting an effective strategy.

You’ll also need to set clear financial goals which align with both your current circumstances and future aspirations. Having these well-defined objectives allows for more informed decision-making when it comes time to allocate resources across various opportunities within the stock market such as dividend stocks or growth investments.

Average Return & Track Record

An essential component when considering any type of long-term investment is looking at its track record and average return over extended periods . By analyzing past performance , investors can gain insight into potential long-term returns . But remember – past performance does not guarantee future results. So make sure always do thorough research before committing any funds

.

Investment Process: Active Trading vs Passive Investing

The method by which one goes about investing matters too . For instance , if someone prefers having direct control over their portfolio , then active trading might be preferable where they regularly buy and sell based on short term fluctuations in share price Conversely passive investing involves less frequent transactions focusing instead on holding onto assets for long periods to benefit from market growth over time

Consider the elements mentioned above to form a solid investment plan that meets your financial objectives and risk tolerance. For more information, check out this comprehensive guide on crafting an effective investment plan.

Investment strategies reflect your financial goals and risk comfort. Identify clear, measurable objectives like retirement savings or wealth accumulation to guide asset choices. Understand the risks you’re willing to bear – remember, not all are equal. Align financial aims with present conditions and future dreams for smarter resource allocation in opportunities like dividend stocks or growth investments.

Evaluate long-term investment potentials by looking at track records and average returns over time – but don’t solely rely on past performance as a predictor of future results.

Your investing approach matters too. Active trading gives direct portfolio control via frequent buy-sell decisions based on short-term market fluctuations; passive investing favors less frequent transactions, holding onto assets longer for sustained market growth benefits.

Real Estate Investment Strategies

Let’s explore the captivating realm of real estate investing. This strategy can be a solid part of your diversified portfolio. It’s like playing Monopoly, but with actual buildings and genuine cash flow.

Multi-Family Vs. Single-Family Property Investments

If you’re considering real estate as a long-term investment, there are two main options to choose from: multi-family or single-family properties.

The first option is akin to owning an apartment building where multiple families reside – think “cash cow.” But remember, more tenants could mean more headaches. Single-family homes may offer fewer headaches and are often simpler to manage, given that they typically only house one tenant.

Turnkey Properties

Another popular strategy involves turnkey properties. Just like buying a car that’s ready-to-drive off the lot without needing any fixes – these types of investments include properties that have been fully renovated and already have tenants in place (sweet.). They can provide instant rental income once purchased – it’s practically plug-and-play for investors.

Growth Investing Strategy Focuses on Long-Term Returns

To further add depth to your property-focused term investment portfolio objectives, consider growth investing strategies involving both short- and long-term returns.

This approach might involve flipping houses or developing raw land; although riskier than passive income methods such as rentals, growth investing focuses on potential price appreciation over time, much like waiting for seeds planted today to become fruitful trees tomorrow.

Risks Involved in Real Estate Investments Include Volatility in Share Price

Lastly, let’s not forget about risks involved in real estate investments. Price appears to be a significant factor, with volatility in share prices and underlying business dynamics affecting returns.

The real estate market, like the stock market, can fluctuate due to various factors – it’s not always sunshine and rainbows.

Income Investing Strategy

buying properties to rent out, offering a steady stream of income. It’s like having your own money-making machine.

Diving into real estate investment can add a solid layer to your portfolio. Choices range from multi-family properties for potential “cash cow” income, single-family homes with less management stress, or turnkey options for immediate rental returns. Growth strategies focus on long-term appreciation but carry more risk. Remember, market volatility affects all investments – it’s not always smooth sailing. Income investing via rentals provides steady cash flow like a personal money printer.

Diversification in Investment Strategies

Putting all your resources into a single venture can be precarious. Diversifying your investment portfolio by spreading your money across different types of investments helps manage risk and increases potential returns.

Diversification doesn’t mean you need to invest in every single type of investment out there. Rather, it’s about finding a balance that aligns with your financial goals and tolerance for risk.

Mixing Individual Stocks and Mutual Funds

Including both single stocks and mutual funds in an investment plan may be advantageous. Mutual funds allow investors to buy a large number of securities at once, providing immediate diversification, while individual stocks let savvy investors target specific companies or sectors they believe will perform well.

The key here is not only picking the right mix but also regularly rebalancing this mix as market conditions change or as you get closer to reaching long-term objectives like retirement.

Focusing on Smaller Companies

Smaller companies can provide opportunities for higher growth rates than larger ones, though they may come with more volatility. For example, tech startups might not have the steady income stream of established corporations but offer the chance for explosive growth if their business model proves successful – remember how Amazon started.

Broadening Horizons Beyond Home Borders

If we consider ourselves global citizens, why shouldn’t our portfolios reflect that? International diversification through foreign bonds or international mutual funds could give exposure to economies growing faster than ours; plus some countries offer attractive tax incentives too. However do bear in mind currency exchange risks involved.

Remember, a diversified portfolio doesn’t guarantee profits or protect completely against losses in declining markets. Creating a diversified portfolio is the most effective way to achieve your long-term investment goals while minimizing risk. Now isn’t that something worth considering?

Spreading your money across various investments can help manage risk and boost potential returns – that’s diversification. Mix up individual stocks and mutual funds, keep an eye on smaller companies for high growth rates, and don’t shy away from going global. But remember, even with a diversified portfolio, it’s crucial to align with your financial goals and be ready for market changes.

Implementing Investment Strategies

Starting an investment journey doesn’t have to be intimidating; there are plenty of platforms that make the setup process straightforward. Establishing a brokerage account is the initial step to enter the stock market, which may appear intimidating but can be straightforward with many user-friendly services such as Fidelity, Charles Schwab or Robinhood.

This may sound complicated, but actually it’s quite simple and there are many platforms that make this process easy for beginners. Some of these include Fidelity, Charles Schwab, or Robinhood.

The next crucial part in implementing investment strategies involves defining your financial goals. Are you saving for retirement? Do you want to build an emergency fund? Or perhaps you’re interested in growing wealth over the long term?

Seek Expert Advice When Needed

If all of this seems overwhelming, remember: no one says you need to do it alone. For those in need of assistance, a financial advisor can provide tailored advice for individual circumstances and goals, considering elements such as risk tolerance and timeline.

A financial consultant can craft an investment plan to fit your personal situation and goals, considering such elements as risk-bearing capacity and time horizon.

Maintaining Financial Security

In order to maintain financial security throughout your investing journey, regular check-ins on your portfolio performance is vital. But don’t panic if some investments aren’t performing as well initially – remember investing is about playing the long game.

Kick Start Your Investing Journey Today

No matter how small or large your initial investment might be – start now. Even modest amounts invested regularly can grow significantly over time thanks to the power of compound interest.

It’s never too early or late to start investing, so why wait? Let’s take control of your financial future today.

Managing Risk in Investment Strategies

The world of investment is a bit like sailing. You have to navigate through calm waters and stormy seas alike, always keeping your financial situation steady. The trick lies in managing risk efficiently.

Investing can range from high-stakes to low-risk, so it’s essential to grasp that within these types there may be distinctions. Just as the ocean’s currents change over time, so too does the stock market’s behavior.

A key strategy for mitigating potential risks involves investing only a small portion of your capital into any single venture. This approach lets you spread out possible losses across multiple investments instead of betting everything on one horse.

Your credit score also plays an important role when seeking loans for larger investments or opportunities that require significant initial capital. But don’t let this discourage you; maintaining good credit isn’t impossible if you’re diligent about repayments and keep track of all due dates. Here’s how.

Maintaining Balance Between High-Risk and Low-Risk Investments

Another effective method is balancing high-risk with low-risk investments in your portfolio – kind of like having both strong winds (high-risk) and safe harbors (low-risk) on our metaphorical sea voyage.

High-risk assets, such as stocks from startups or volatile industries offer potentially huge returns but could sink just as quickly. Learn more here. On the other hand, low-risk options, including government bonds and stable dividend stocks, may provide smaller but more reliable returns.

Striking the right balance between these investment types is crucial to manage potential losses and still achieve substantial growth over time.

Diversification: Your Financial Lifeboat

Managing risk can be effectively done through diversification. When you spread your investments across various sectors, industries, and regions, it’s like having a safety net during downturns.

Long-Term Investment Strategies for Beginners

Navigating long-term investments can be daunting for the novice investor; however, with these strategies you’ll soon have a firm grasp of the fundamentals. But don’t fret. You’ll learn some strategies here to help you get started.

Reverse Wholesaling

This popular strategy involves buying properties at low prices and selling them when their future price appears promising. It’s akin to hunting bargains during sales season, then reselling the items when they are back in demand.

A great example of reverse wholesaling is the stock market where investors buy shares whose share price appears undervalued due to temporary setbacks in an otherwise strong underlying business.

Dollar-Cost Averaging (DCA)

DCA is another effective method that financial advisors often recommend. With DCA, you invest a fixed dollar amount into your chosen investment at regular intervals over long periods – think feeding coins into a piggy bank every week instead of stuffing it with bills all at once.

The Best Investment Strategies For Beginners provides more information on this approach.

Growth Investments and Dividend Stocks

Betting on growth investments like technology or healthcare stocks may seem risky but can lead to substantial long-term returns if the company performs well. Think about Apple or Amazon; early investors who held onto these stocks are now reaping huge rewards.

A Guide For Real Estate Investors, explains how investing in dividend-paying stocks is also a common income investing strategy as it focuses on generating steady earnings through dividends rather than capital gains.

Your Personal Finance Goals Matter Too.

- Fulfilling your financial goals should be central while choosing an investment strategy.

- Recall, each plan carries its own hazards and benefits. So, you need to balance between the two based on your risk tolerance.

- A retirement account might be a safer option if security is your priority while an active trading approach may suit those looking for higher returns.

No matter which path you choose, investing involves careful planning and patience – think of it as planting a seed and nurturing it into a tree.

Starting your investment journey? Dive into strategies like reverse wholesaling, where you buy low and sell high. Try Dollar-Cost Averaging (DCA) – regularly investing a fixed amount over time. Consider growth investments or dividend stocks for potential long-term returns. But remember, align these with your personal finance goals and risk tolerance.

FAQs in Relation to Investment Strategies

What are the 4 main investments?

The four primary types of investments are stocks, bonds, mutual funds, and real estate.

What are the three types of investment strategies?

The big three investment strategies typically include growth investing, income investing and value investing.

How do you invest strategically?

To invest strategically means to have clear financial goals, understand your risk tolerance level and diversify your portfolio across various asset classes.

What are examples of strategic investments?

A few examples could be buying shares in a promising start-up (growth strategy), purchasing dividend-paying stocks (income strategy) or snagging undervalued assets (value strategy).

Conclusion

So, we’ve taken the plunge into the world of investment strategies. We’ve studied short-term and long-term investing approaches. We’ve explored real estate methods and how to manage risk.

We discovered that investment isn’t just for finance pros. It’s for anyone ready to take control of their financial future.

Diversification is key in your strategy, as it helps protect your financial situation. And remember: every investor started somewhere!

If you’re a beginner, focus on understanding different strategies first before diving headfirst into active trading.

The bottom line? Start investing today with a well-defined plan – Your future self will thank you!

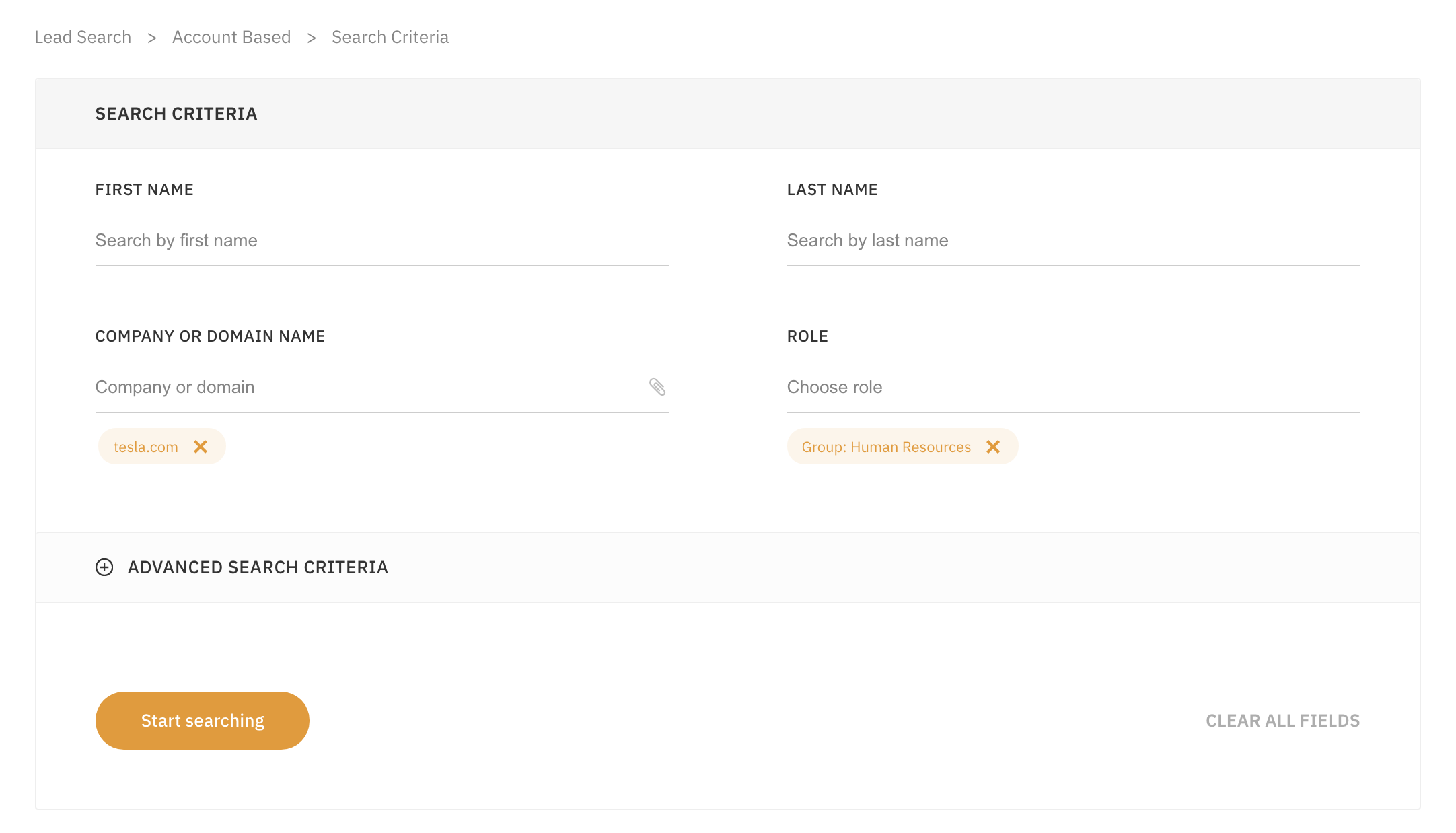

Need Help Automating Your Sales Prospecting Process?

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!