Ever wonder why is diversification a recommended investment strategy? Imagine being at a restaurant that has an unlimited selection of food. You wouldn’t pile your plate with just one type of food, right? Just like in investing, where the ‘buffet’ is full of different asset classes – stocks, bonds, real estate and more.

In the same way you’d pick various dishes to enjoy a balanced meal, diversifying your investments across these assets can help manage risk. It’s not about putting all your eggs into one basket but spreading them out so if one falls over or performs poorly under market conditions; it doesn’t ruin the entire nest egg!

investment strategy. With a balanced mix of assets, you can better manage potential risks and aim for growth. So, ready to whip up your own financial feast? Let’s explore why mutual funds might just be the secret ingredient in your diversified portfolio recipe.

Table of Contents:

- Understanding Diversification and Its Importance

- The Basics of Diversification

- Benefits of Diversification

- How Diversification Works

- Implementing a Diversification Strategy

- Diversifying with Mutual Funds and ETFs

- FAQs in Relation to Why is Diversification a Recommended Investment Strategy

- Conclusion

Understanding Diversification and Its Importance

By analogy to the game of Monopoly, diversification is essential in investing for financial security. Just like owning properties across different colors on the board can protect your finances during gameplay, a diversified investment strategy works similarly in real life.

Diversifying your portfolio is much like spreading out your houses and hotels across Park Place, Marvin Gardens, or even Baltic Avenue. It’s all about not putting all your eggs—or should we say Monopoly money—in one basket.

The Role of Diversification in Risk Management

So why is diversification a recommended investment strategy? Well for starters, it helps to manage risk. By choosing different investments within various asset classes—just as an astute player would acquire varied property groups—you reduce the impact if any single investment performs poorly.

Wells Fargo puts it best, likening this approach to not betting everything on red at roulette; rather spread bets around the table. In terms of investing basics that means distributing those precious investment dollars amongst stocks (like buying up Boardwalk), bonds (think railroads) and cash equivalents (those utility companies).

A Game Of Strategy: Asset Allocation

You might be asking yourself now – how do I start with my own diversification strategy? To begin with consider each potential ‘property’ aka asset class – from high growth tech stocks through to stable government bonds – just as unique elements on our Monopoly board.

This isn’t about going after every opportunity blindly though. Rather careful asset allocation should balance a portfolio, splitting assets among different categories in a way that reflects your financial goals and risk tolerance.

The Winning Combination: Diversified Investments And Risk Reduction

Diversification can reduce the likelihood of major losses. It’s similar to having multiple paths to victory in Monopoly – if one strategy fails, you’ve got others as back-up.

This is because each type of investment or asset class performs differently under varying market conditions – sometimes they rise when others fall, providing an overall smoother ride for investors generally.

So there we have it, folks. Understanding diversification isn’t just a game, but an essential strategy for financial success. It’s about spreading your investments wisely to manage risk and maximize returns.

Think of diversification as playing Monopoly – owning properties across the board protects your finances. Similarly, spreading investments in various asset classes reduces risk and optimizes returns. It’s not about chasing every opportunity but strategically allocating assets according to your financial goals and risk tolerance.

The Basics of Diversification

By spreading out your investment dollars across multiple asset classes, you are reducing risk and balancing your portfolio. This approach helps balance a portfolio by allocating assets among categories.

But what exactly does this mean? Well, each asset class tends to react differently to similar market conditions. For instance, when stock prices fall (which could happen during economic downturns), bond prices may rise or remain stable because they are perceived as safer investments.

In essence, diversifying involves investing in various types of financial products and accounts. It’s not just about owning multiple stocks but rather an assortment of asset categories – from real estate to commodities like gold or oil.

Asset Classes Explained

If we were on a safari trip through the wild terrain of investing basics called ‘Asset Classes’, our first stop would probably be at Stocks Lane. Stocks represent ownership in companies and generally carry higher risks with potentially high growth rewards too.

A short drive away lays Bonds Boulevard where investors lend money to entities (like governments or corporations) who promise fixed returns over time – making it less risky than stocks but also usually offering lower potential profits.

Cash Equivalents: The Safe Haven?

Our final destination within this adventurous ride would lead us towards Cash Equivalents Cul-de-sac which includes highly liquid securities like money market funds or Treasury bills. These are considered the safest investments but also yield lower returns.

By having a diversified investment portfolio that spans across these various asset classes, you’re creating an effective buffer against volatility in any one area. This can help ensure smoother and more consistent growth of your wealth over time.

But how much should you invest in each class? That’s where asset allocation comes into play. It is essentially a strategy to divide your

Diversification is like not putting all your eggs in one basket. It’s spreading investments across stocks, bonds, and cash alternatives to lower risk. Each asset class reacts differently to market changes – so having a mix helps smooth out volatility and promotes consistent growth. The exact investment split? That’s where asset allocation steps in.

Benefits of Diversification

Diversification, a crucial part of investing basics, is like the safety net for your investment dollars. It’s not just about throwing money into different pots but strategically placing them in various asset classes such as stocks, bonds, and cash equivalents.

The beauty lies in how these investments perform differently under market conditions – when one goes down, another might go up. This juggling act reduces risk and could potentially lead to higher growth over time.

The Impact of Diversification on Wealth Accumulation

A diversified portfolio isn’t simply spreading your bets around; it’s about building wealth while keeping an eye on the volatility ball. Just imagine if you had all your eggs in a single basket (say real estate), and prices fall due to unforeseen circumstances? You’d be left holding onto depreciating assets with no backup plan.

On the flip side, having a well-diversified investment strategy can give you some peace during turbulent times. For instance, bond prices typically rise when interest rates fall—thus providing stability even when stock markets are taking hits.

JP Morgan Asset Management Guide to the Markets further highlights that diversifying across different asset classes may enhance risk-adjusted returns and help minimize overall portfolio losses.

You see why financial experts often equate diversification with wisdom—it’s essentially insurance against unpredictable market fluctuations. So whether you’re at a high-growth phase or nearing retirement looking to preserve capital, implementing this tried-and-tested method makes good sense.

Frequently Asked Question: Is there something called too much diversification?

In theory yes – more isn’t always better. Too much diversification, often called ‘diworsification’, could lead to a dilution of returns and prevent your portfolio from hitting its targets. It’s critical to discover the ideal harmony between hazard and remuneration.

Just keep in mind, spreading your investments may help handle risks, but it doesn’t wipe them out entirely. Markets shift often—that’s why you need to consistently check on your investment.

Diversification isn’t just about splitting your money, it’s strategic investment in different asset classes for safety and growth. It manages risk by ensuring not all ‘eggs’ are in one basket, thus safeguarding against market fluctuations. But be cautious. Over-diversification can dilute returns – balance is key. Always remember: diversifying helps manage risks but doesn’t eliminate them entirely.

How Diversification Works

By diversifying your investments, you can spread the risk of putting all your eggs in one basket. But how does it actually work? Well, diversification involves spreading your investment dollars across different asset classes such as stocks and bonds. The aim here is to minimize risk – when some investments perform poorly under certain market conditions, others may do well.

In essence, you’re playing both sides of the field with this diversified investment strategy. Think about it like having a balanced diet for your portfolio; too much of anything can be harmful. For instance, investing solely in fixed income investments like bonds might sound safe because they promise regular returns (interest from the bond issuer), but what happens if interest rates fall?

You guessed right – bond prices fall. And just like that one bad apple spoiling the whole bunch (I mean… who likes bruised apples?), a single dip in interest rates could impact your entire portfolio’s performance.

Playing The Field: Stocks and Bonds

This isn’t an invitation to turn into Wall Street’s latest cowboy or cowgirl by buying every stock available. Instead think about incorporating various types of securities including foreign stocks and international ones which behave differently under varying market conditions. By doing so you get exposure to high growth opportunities without being overexposed to higher risks associated with individual markets or sectors.

A great analogy would be cooking up a delicious stew – while each ingredient brings something unique to the table (pun intended), their flavors blend together perfectly creating harmony even though individually they are quite distinct.

The Numbers Don’t Lie

And just like that stew, you might be wondering how well these ingredients mix together. To give an idea of the correlation between U.S. large-cap stocks and bonds – it’s 0.26 according to financial experts.

What does this correlation signify in layman’s terms? This low correlation shows that these asset types usually behave differently under similar market conditions. For instance, when stock prices take a tumble, bond prices often rise.

Diversification is like cooking a delicious stew with your investments – blending different asset classes such as stocks and bonds. It’s all about not putting all your eggs in one basket to minimize risk. Just like each ingredient brings unique flavor, diversifying gives you exposure to growth without being overly risky. The correlation between U.S large-cap stocks and bonds shows these assets often behave differently under similar market conditions, adding more reason to diversify.

Implementing a Diversification Strategy

Implementing a diversification strategy is like building your dream house. You wouldn’t use only one type of material, right? Instead, you’d mix and match to make sure it stands strong against all weather conditions. This principle holds true for your investment portfolio as well.

Your financial goals and risk tolerance play crucial roles in shaping your diversification plan. If you’re looking to grow wealth over time, investing more heavily in stocks might be beneficial because they offer higher potential returns but with increased volatility. However, if capital preservation is important (especially nearing retirement), then bonds or cash equivalents can provide stability despite offering lower returns.

Choosing the Right Investments for Your Portfolio

Finding suitable investments that align with your individual needs can feel daunting at first glance – kind of like choosing between brick or wood for that dream house. Thankfully, investment professionals, such as financial advisors, are available to help guide these decisions based on their knowledge about different asset classes and how they perform under various market conditions.

Balancing growth-oriented assets (like stocks) with income-generating ones (like bonds) can create an effective buffer against volatile market scenarios while still aiming towards achieving long-term financial goals. Moreover, factoring in personal elements like risk tolerance and time horizon also helps tailor this balance further to ensure it resonates deeply with individual investor preferences.

Diversifying isn’t just about spreading out money across multiple investments; instead, it’s thoughtfully selecting diverse assets which react differently under similar circumstances – sort of like ensuring our hypothetical house has both insulation for cold winters and cooling systems for hot summers.

In conclusion – whoops sorry no conclusions here folks. Creating a diversified portfolio tailored to individual financial objectives, risk tolerance and timeline is key for successful investing. It’s about crafting an investment strategy that caters to your specific financial goals, risk tolerance, and timeline. And while it doesn’t eliminate risk entirely, it can certainly help manage it better.

Think of diversification as building a house using various materials for resilience against all weather. It’s about mixing growth-oriented assets and income-generating ones to buffer market volatility, aligning with your financial goals and risk tolerance. Remember, it’s not just spreading money but selecting diverse assets that react differently under similar circumstances.

Diversifying with Mutual Funds and ETFs

Mutual funds and ETFs are like a multi-tool, offering access to different types of assets for portfolio diversification. Mutual funds and ETFs offer a means to gain exposure to numerous stocks, bonds, or other assets in one bundle. This makes them great options for achieving portfolio diversification.

Let’s get this straight: when it comes to diversification, these investment products are hard hitters. You might be asking yourself “Why?” Well, here’s why:

- Access to a Broad Market: These funds invest in an assortment of securities which means they can help spread out your risk among many companies or sectors.

- Simplicity: Instead of researching every single company stock or bond, mutual funds and ETFs let investors buy a basketful at once.

- Liquidity: Unlike some investments that require you to lock up your money for longer periods (looking at you real estate), both mutual funds and ETFs offer daily liquidity.

This is where things get interesting. If we take JP Morgan Asset Management Guide’s suggestion about how asset classes perform differently under various market conditions into account… then BAM. We realize that not all stocks react similarly during market changes.

To illustrate my point: Imagine having two children who act completely different even though they’ve been raised under the same roof by the same parents (I’m sure many parents reading this can relate). That’s exactly what happens with different types of stocks – even though they belong to the ‘stock’ family, they might react differently based on market conditions. This phenomenon can offer you an additional layer of diversification.

Where do mutual funds and ETFs fit in? They’re like a diverse neighborhood that brings together these unique stocks (children in our analogy) under one roof.

stocks and bonds to invest in. These professionals constantly monitor the market, make calculated risks, and aim for returns that align with the fund’s investment objectives. This is a great way for beginners or those who don’t have time to manage their own investments.

Think of mutual funds and ETFs as your investment Swiss Army knife. They offer broad market access, simplicity, and liquidity to diversify your portfolio effectively. Like children raised under the same roof behaving differently, stocks react uniquely to market changes – providing another layer of diversification. Mutual funds and ETFs gather these unique ‘children’ in one diverse neighborhood.

FAQs in Relation to Why is Diversification a Recommended Investment Strategy

Why is diversification a recommended investment?

Diversification helps manage risk by spreading investments across different asset classes. It reduces the impact of one poor performer on your entire portfolio.

Why is diversification a recommended investment strategy quizlet?

Diversifying allows for potential gains in various sectors, helping offset losses if some areas perform poorly. This balance promotes steadier overall growth.

Why is diversification the best strategy?

A diversified portfolio can provide better risk-adjusted returns over time. Diversification lowers volatility and protects against market swings, supporting steady wealth accumulation.

Why is diversification a recommended investment strategy group of answer choices?

The main reasons are: managing risk, increasing potential for return, ensuring liquidity, and safeguarding against market fluctuations – all key to long-term financial success.

Conclusion

Investing is a quest, not an endpoint. And in this exploration of why diversification is a recommended investment strategy, we’ve traveled far.

We learned that diversification reduces risk by spreading investments across different asset classes like stocks and bonds, which perform differently under various market conditions. Remember: It’s about balancing the ‘buffet’ of assets for optimum portfolio performance.

We also discovered mutual funds and ETFs can be valuable tools for achieving diversification easily. But remember: Always tailor your strategy to fit personal financial goals and risk tolerance.

In conclusion, investing without diversity is akin to eating at an all-you-can-eat buffet but only choosing one dish – you miss out on so much more!

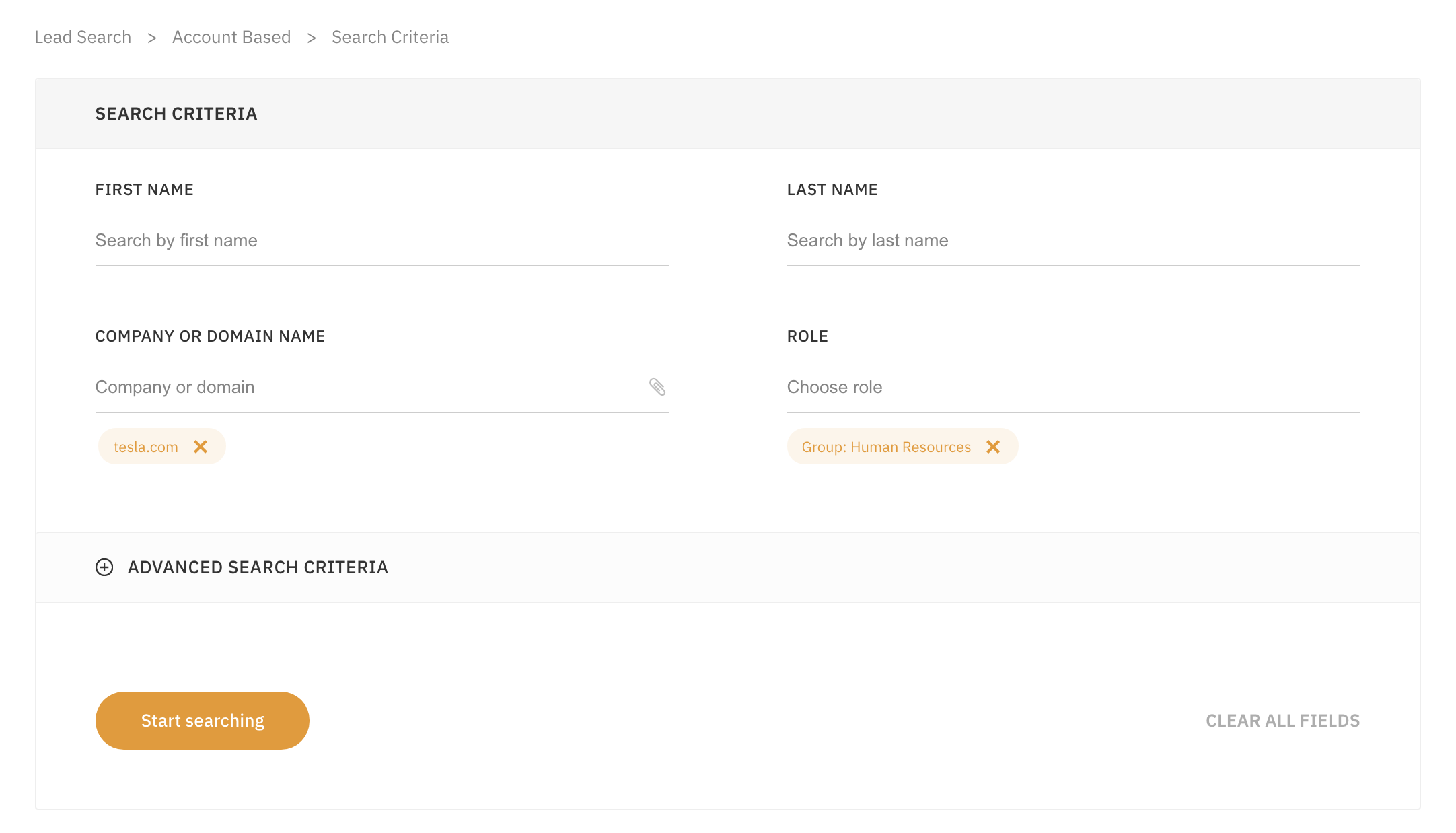

Need Help Automating Your Sales Prospecting Process?

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!