https://virtualvalley.io/ppc-stands-for/

How to Generate Insurance Leads – 33 Ways That Work.

There are many ways you can get insurance leads. Your success, however, lies in using the ones that take the least effort, time, and money.

So if you are a new agent wondering how insurance agents get leads, here are 33 ways to get you started:

1Customer referrals

Getting referrals is the easiest and cheapest way to get life insurance leads. To get referrals, you need to find out who your target customer’s friends or colleagues are, then reach out to them with an email that introduces your service and audience of customers.

Instead of waiting for current customers to refer their friends and colleagues, you can incentivize them:

2 Run a referral program

Offering a referral program is one of the best ways to get insurance agency leads. You can say that for every referral that signs up with your company and buy your services, the customer the referring customer receives 5 percent off their policy when they renew.

(Image Source: Disruptive Advertising)

3 Use social media

With the ever-growing popularity of Facebook, Twitter, Instagram, and TikTok, you can reach a lot more people on social media than you can get with traditional marketing. You can also schedule posts on Facebook and other platforms so that your posts come out when your audience is online. Social media is a free lead generation channel that any business can use. Just remember that most of your competitors are likely targeting it for the same reasons.

4 Google search ads

More and more people are using Google to research purchases and search for information online. This makes PPC (Pay Per Click) advertising an effective way to get life insurance leads for agents. Though it has a learning curve, PPC is fairly inexpensive because you only pay if people click on your ads.

5 Email marketing

This strategy involves sending an email newsletter to your customer base on a regular basis, in order to keep them up-to-date with new products or services you offer and other important information.

Done right, this can also lead to more insurance leads for the company because recipients will be more likely to share the email with others. You have to remember, though, that you have to build an email list first, and that can take time and a significant investment in content.

Speaking of content:

6 Create a blog

Creating and writing a blog is an excellent way of attracting insurance leads as it boosts your insurance agency’s visibility online at a low cost. Once readers are onsite, the blog can guide potential customers through your sales pipeline by providing them with valuable content that is relevant to them.

Still on writing a blog, that blog has to live somewhere:

7 Create a good website

Creating a website for your insurance agency gives the perception that you are professional and are in this industry to stay. This is crucial for attracting leads because there are many people searching the internet for the insurance products you sell.

You want your website to make a strong impression on them when they land there. The navigation elements must make it easy for visitors to find the information they need. Do not make your visitors work to find what they need.

Make sure you’re including all the relevant information about your company on your website. This will make it easier for potential customers to find and contact your company.

8 Purchase lead lists

In simple language, this is when you buy insurance leads. What you essentially get after paying the money is a list with people’s names and email addresses.

Though buying insurance leads can get expensive fast and is usually not very effective since the quality of the leads is usually poor, it can give new agents an early boost and confidence to try more sophisticated lead generation strategies.

9 Search engine optimization (SEO)

SEO is a digital marketing tactic of optimizing your website to rank higher in Google and other search engines for search queries that are relevant to your business. This will not only bring people to your site but also help you convert them into customers by providing high-quality content tailored to their needs.

Let’s circle back to buying leads and consider what to do with the leads you acquire:

10 Cold calling

Cold calling is one of the most effective strategies for getting insurance leads. Remember you bought a list of people who can potentially be interested in buying insurance coverage.

Since this is not a list you generated from your own content marketing efforts, you cannot be sure if the people are indeed interested in your products. To inquire and gauge their interest, you cold call, which is when you phone to prospect someone who is not expecting your call.

Even though this is hard since this lead has not expressed an interest in the policy you are selling, be sure you have an idea of the type of coverage they might need and what your offer is going to include.

For example, if you are a property and casualty agent, it’s likely that you are selling homeowners’ or renters’ policies, so make sure that this information shows up in any written materials you have on hand.

(Image Source: JustCall)

11 Get listed on reputable review sites

One way to get insurance leads online is by getting listed on reputable review sites. You can do this by paying a fee or filling out a form with your contact information and what you offer. In return, the site will list your company as an option for people looking for insurance quotes.

12 Host webinars

Hosting a webinar is another great way to get more insurance leads. Webinars are interactive, which means your potential customers will be able to learn about what you do and ask questions in real time. They can also opt-in for future communications at the end of the session if they want to learn more about your insurance products.

13 Provide excellent customer support

If your customer service is top-notch, you’ll get more leads. When someone has an issue or question with their current insurance company, they may inquire about contacting yours for a quote. In order to do so, the person will need to provide contact information and personal details. That contact information counts as leads.

Great customer support also encourages word of mouth where your existing clients talk positively about your insurance agency. Even though people are more likely to complain about poor customer service than spread the word when served well, a few will still say nice to things about you to their network.

14 Networking

Networking can be a great way to generate insurance leads. Any new connections you make through your networking effort are a potential insurance lead source. By connecting with them on social media or in person, they’ll know about your business and help amplify your messages.

15 Join forums

Joining forums related to your industry is another useful way to find insurance leads. By helpfully answering questions from other forum members, you come off as knowledgeable and trustworthy.

In the process, you build up a reputation as an expert and information resource. The next time you plug your insurance products into a conversation, people are likely to be more receptive.

16 Craft valuable, shareable content

The more people that read your content, the better. One great way to do this is by creating curated articles or videos about an insurance product and sharing them on social media. If one of your social media posts goes viral, the impact on insurance lead generation efforts can be huge.

17 Use online as well as offline ads

If you’re going to pay for advertising, make sure it’s worth your money. Take care in picking the right keywords and setting a budget so that every dollar is well spent on getting leads rather than letting them go to waste.

But even though online ads are growing in popularity, don’t discount the enduring value of offline ads. If they fit your insurance product, consider putting up a banner ad on a busy highway, placing an ad in a local newspaper, or buying a spot on a radio show to educate people on the benefits of insurance.

18 Join insurance associations

An effective way of building up an online reputation and expanding your insurance lead sources is by joining industry-related associations such as the Canadian Insurance Association. Doing so will expose you to other people in the industry, as well as give your company a chance to be featured on its newsfeed.

19 Become an expert in insurance

If there’s one thing that insurance leads find appealing with an insurance agent, it’s expertise. So if you’re looking for some ways to stand out from your competitors then you should build up your expertise in the field of insurance.

You can do this by blogging, speaking at conferences, or even running a workshop on something you’re knowledgeable about such as life insurance for seniors.

20 Build relationships with people that aren’t clients

After a while, it can get quite tedious scouring the same places for insurance leads. If generating insurance leads now feels like that for you, you need to start looking outside your usual client sphere and build relationships with people that you know don’t currently buy your products or services.

You can start by connecting with new people on LinkedIn and following these contacts to see what they’re up to. Then after a while, reach out to them for a coffee date when it’s convenient.

21 Direct requests

This is an underutilized insurance prospecting idea. Its beauty is in its simplicity. When everyone else is trying shiny new tools and sophisticated ways to generate more insurance leads, you simply go door-to-door or set up a table at a fair (target farmers’ markets if you sell crop insurance).

But you may need to get creative and not come off as aggressive or like you are only interested in selling policies. A tip is to inquire about your targets’ biggest frustrations with their current insurers. If your policies are better in that regard, offer it as an alternative.

22 Offer free advice

Who doesn’t want free advice? You can offer free insurance advice by posting on social media, telling people that you’re available to give free advice, and answering any questions they might have about insurance.

Research and write exhaustive threads about a popular topic on Twitter. As more people like, retweet, and comment on your thread, you’ll make new connections generate new leads for your insurance agency.

23 Strike up partnerships

An indirect and yet effective way to generate insurance leads is striking up new partnerships with other businesses. For example, you can partner with an auto-repair business where you refer each other’s services to each other’s customers.

You recommend your clients that need auto repair services to your partnering garage and they recommend your auto insurance policies to their own customers. It’s a win-win.

24 Conduct giveaways

Again, here you are harnessing people’s enduring appetite for freebies. Find a way of running a contest of sorts – through social media, your website, or other platforms – and give away something nice, like an iPad, or auto-detailing service (from that garage you have partnered with).

The contest can create a lot of buzz that can transform into an interest in your services. The key here is to be original – try to be as creative as you can with the giveaway.

25 Stay on top of the latest trends in your industry

In order to get leads for your insurance agency, it’s important to stay up-to-date with the technology trends like predictive AI models. It’s also important to pay close attention to what other businesses are doing in this field and then take advantage of any new opportunities that arise.

Insurance prospecting ideas don’t have to be original. For instance, if you find out that a competing agency in your area is growing rapidly, you might want to find out how they are doing it. You can reverse-engineer their strategies and improve on them.

26 Keep an eye on what people are saying about your company online

Even if you may not want your team to use social media sites like Twitter and Facebook while they’re working, specific employees should still be checking these sites throughout the day.

You should constantly check for any issues that are popping up about your company. If it’s something negative, you want to quickly get on top of the conversation and give your official position. Where it is a positive mention, you want to be quick to acknowledge the positive sentiment. This publicity is great for insurance lead generation.

27 Network at events in your industry

There are other ways to reach potential customers than just through social media or online advertisements. In fact, many people have found that it’s best to go out into the world and meet people in person!

Take a day every week or two and attend one event related to your industry – whether that’s an expo for companies selling insurance products, association meetings such as those held by ARDA International, or conferences such as those held by the American Institute of Certified Public Accountants. You will find many opportunities to plug your products there.

28 Join industry groups on social media

Facebook for one has groups on the most random subjects. Find groups in your industry on sites like LinkedIn and Facebook, or those dedicated to insurance professionals such as ARDA International’s Insurance Professional group, and get involved with them!

29 Run promotions

A surefire way to attract new insurance leads is by running promotions where you offer discounts for people who sign up during a specific period. An example is to run a Black Friday or Cyber Monday promotion. Those are always effective as people are in spending mode during that time of the year.

30 Sponsor local events

Sponsoring events in your local area is a great way to get noticed and build relationships with potential insurance leads. Consider sponsoring car washes, concerts, or even an event at the library.

You never know who might decide they want insurance when you’re supporting them, just so they can respond in kind to your good gesture!

31 Offer branded free merchandise

Part of spreading the word about what you do and getting prospects to know, like, and trust you is to reward your clients with free gifts when they renew.

But instead of giving them an unmarked umbrella or t-shirt, brand it and kill two birds with one stone. While you have rewarded your customer for renewing their policy, you are also sending them on a publicity job through the branded item they will be wearing around town.

You can also brand your own vehicles and use them to

32 Utilize Guerilla marketing

Guerilla marketing is a non-traditional type of advertising that uses creativity, humor, and surprise to grab attention. An example would be if you put an ad for your insurance agency in the back window of your car for when it’s parked at work all day!

33 Create a Portfolio

You can create an interactive portfolio for your insurance company to present your work and get leads. Show this interactive presentation to your potential clients and make them understand what you could do for them.

Also, you can present the benefits your insurance is offering and add logos of the companies that are already collaborating with you (after you get their permission to do that). You can add testimonials from companies or individuals to whom you have provided insurance.

(Image Source: Texas Instruments)

Before You Buy Insurance Leads, Consider These 5 Things

There are times it’s appropriate to buy insurance leads, but there are some things to watch out for in doing that. Here are some of them:

1 False information

Some insurance lead sources will give inaccurate information in order to get money from you. You have to be careful that the information they give is accurate and legitimate.

Contact information equals a lead, so if that information is false, you have no leads. At worst, you waste resources on a lead that will never convert.

2 A lack of contact information

If you’re not able to get in touch with the lead seller, how can you know if they are legitimate? You have to make sure that a potential insurance leads provider is available for any questions and concerns. Use legitimate insurance leads generation providers.

3 No guarantee of quality

Some sellers of lead lists will offer different levels of service – like 500 or 5000 leads. You need to be aware of the levels of service that you’re paying for and make sure it’s worth what you’re getting in return.

4 Outdated information

Some lead sources will give out outdated contact information. Make sure the company you’re using has current information on the leads they sell. A discontinued phone number, an abandoned email, and an old physical address all render a lead useless.

5 Fake contact information

Without the proper contact information, you can’t verify the legitimacy of a lead source. Without that verification, it’s likely that your leads are coming from fake sources and not giving you what you’re looking for.

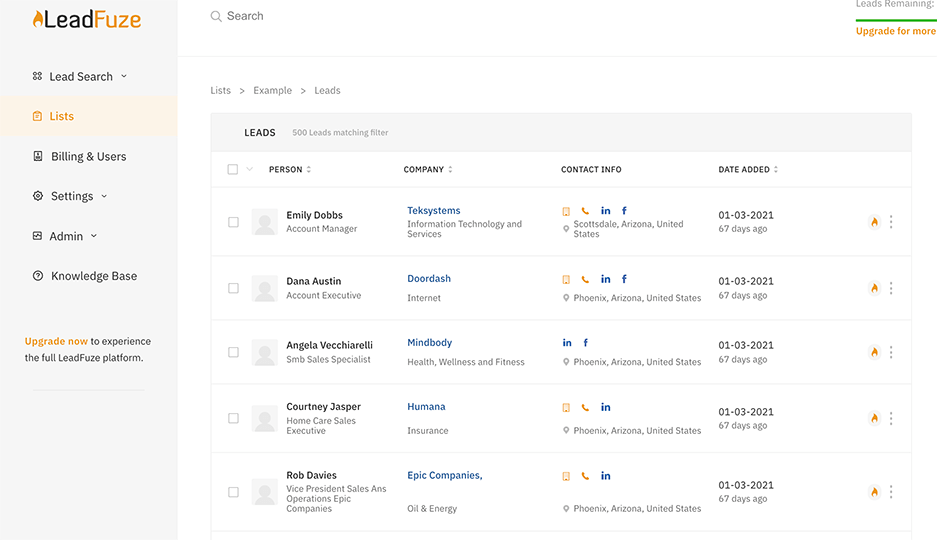

Are you struggling with unreliable lead data?

LeadFuze can help.

The LeadFuze CRM provides updated insurance lead information with the help of Fuzebot. It even gives pre-qualified lead data and utilizes email verification to make sure that each lead is valid.

Yep, LeadFuze can help you avoid the problems we mentioned above. The LeadFuze team has over 10 years of experience in the industry, so we know what it takes to generate leads that your business can rely on.

So, if you’re looking for an easy way to find quality insurance leads without all the hassle, look no further than LeadFuze.

Sign up today for a free trial!

11 Insurance Prospecting Tips to Try Today

The following can help you generate leads regardless of the type of insurance you offer, whether it be liability insurance, long-term care insurance, health insurance, disability insurance, life insurance, home insurance, car insurance, etc.

1 Know your audience

If you know who your target audience is, it’ll be much easier for you to reach and prospect them. Know their most pressing, urgent needs and offer content and advice that address them. For example, offering retirement planning tips is a great way to market yourself as a life insurance agency.

2 Create a value-packed website

The best ways to get free insurance leads online insurance leads are through your website. Focus on creating a beautiful, easy-to-use website where your target audience is happy to hang out. Unlike your Facebook page, your website is your own online property that you control and where no one can just change rules.

Make sure your articles and product pages are top-notch. Make sure your contact information is easy to find. Whatever way prospects can reach you – through email, on the phone, and social media- make it easy for them.

3 Target local smartphone users

If you’re running a mobile insurance app, then it’s important to know that smartphone users typically search for deals and offers when they are on the move. That means your best bet is to target local smartphone users who may be looking for your service.

In 2018, 40% of smartphone users with less than $50,000 annual income purchased personal insurance using their mobile phones. Reflect on that statistic before if you think mobile apps are an overused marketing channel.

4 Optimize for search

Search engines are the number one way people find information. To help your insurance agency get found online, you’ll want to optimize your website content around topics your target prospects are actively searching for on search engines like Google and Bing.

5 Personalize Facebook insurance ads

When it comes to Facebook advertising, you’ll want to include a custom ad that includes your business logo and contact information. This will create a sense of urgency and boost brand identity in potential customers as they move around your target locales.

If someone is searching for an agency like yours but doesn’t know where to find it, they’ll see your ad and know that you’re just a few miles away.

(Image Source: Design Pickle)

6 Make sure your website has a responsive design

Mobile versions of websites are an effective way for insurance agencies to reach potential customers on the go. These are prospects who may be searching for rates or policies on their commutes to and from work.

A website created with responsive design will automatically adjust the layout of your site to fit on smaller screens, making it easy for potential customers who are searching from their phones.

7 Utilize lead magnets

A lead magnet is a free offer that you can use to draw in potential customers through email or social media.

For example, if your agency provides home insurance for pets, consider giving away pet care plans with the purchase of pet insurance coverage. This way you can get more insurance leads coming into your inbox that you can use to sell your other insurance products.

Here are a few types of lead magnets to consider:

- Free insurance consultations for first-time customers,

- An eBook with information about insurance plans and coverage options,

- A coupon code for a discount on their next purchase,

- Lead magnets that tie into customer interests such as recipes, travel guides, or book and movie reviews.

8 Make videos

Video marketing is a great way to reach potential customers. It’s a content format that many people enjoy. Videos can be produced in different formats, from short clips on YouTube to full-length movies.

Whichever type of video you choose to produce, it should provide value. For example, helpful tips or answers to questions people buying insurance for themselves or their family members frequently ask.

9 Offer interactive tools

Research tools that help prospects interact with your marketing materials. QR codes for example became very popular during Covid for helping people stay safe while enjoying some contact with a product or its marketing materials.

Other interactive tools you could use include infographics about the different types of insurance, how to get quotes or apply for coverage, and explanations of what key terms mean.

10 Get listed on local directories

Listing your business in local directories will help potential customers find you. This can be done by contacting the mayor or city council members, and also includes submitting listings to sites like Yelp, The Better Business Bureau, Google+, Citysearch, and others.

Expand Your Insurance Lead Sources and Drum Up More Business for Your Agency

Overall, getting insurance leads is a process that can take time, so you want to be using as many lead sources and tactics as you can. The tips we have shared are enough to get new agents started and increase lead generation bandwidth for established agents.

Remember, though, that leads need to be carefully nurtured to transform their interest into genuine purchasing intent. You should be scrupulous when vetting and qualifying your leads so you don’t end up prospecting insurance leads that have little chance of converting into actual policy buyers.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!